As tax season approaches, it’s important to be prepared with all the necessary forms and documents to file your federal taxes accurately. One crucial aspect of this process is obtaining the correct tax forms for the year 2023. Fortunately, the IRS provides printable versions of these forms on their official website for easy access.

Whether you are an individual taxpayer, a business owner, or a tax professional, having access to printable federal tax forms for 2023 can streamline the filing process and ensure compliance with tax laws. These forms are essential for reporting income, deductions, credits, and other relevant information to calculate your tax liability accurately.

Federal Tax Forms 2023 Printable

Federal Tax Forms 2023 Printable

Save and Print Federal Tax Forms 2023 Printable

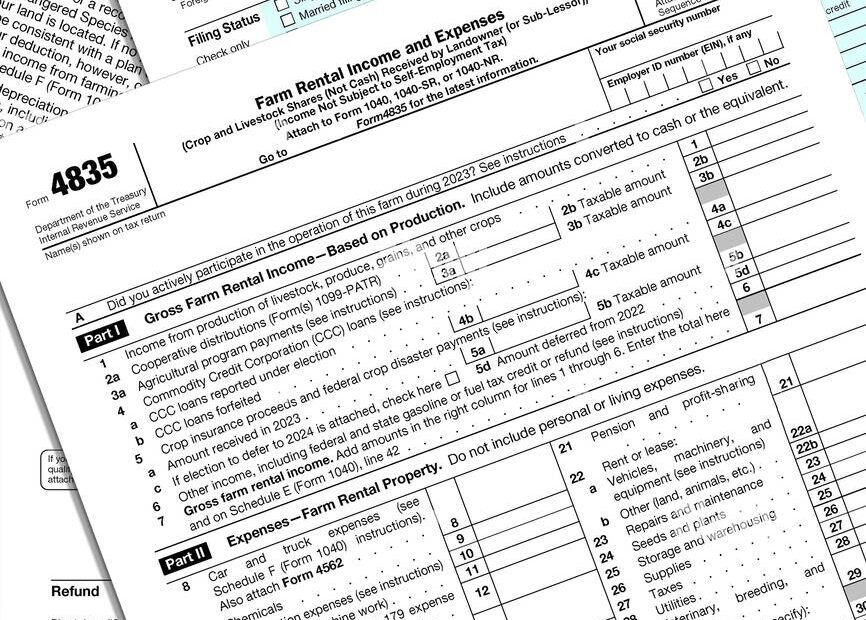

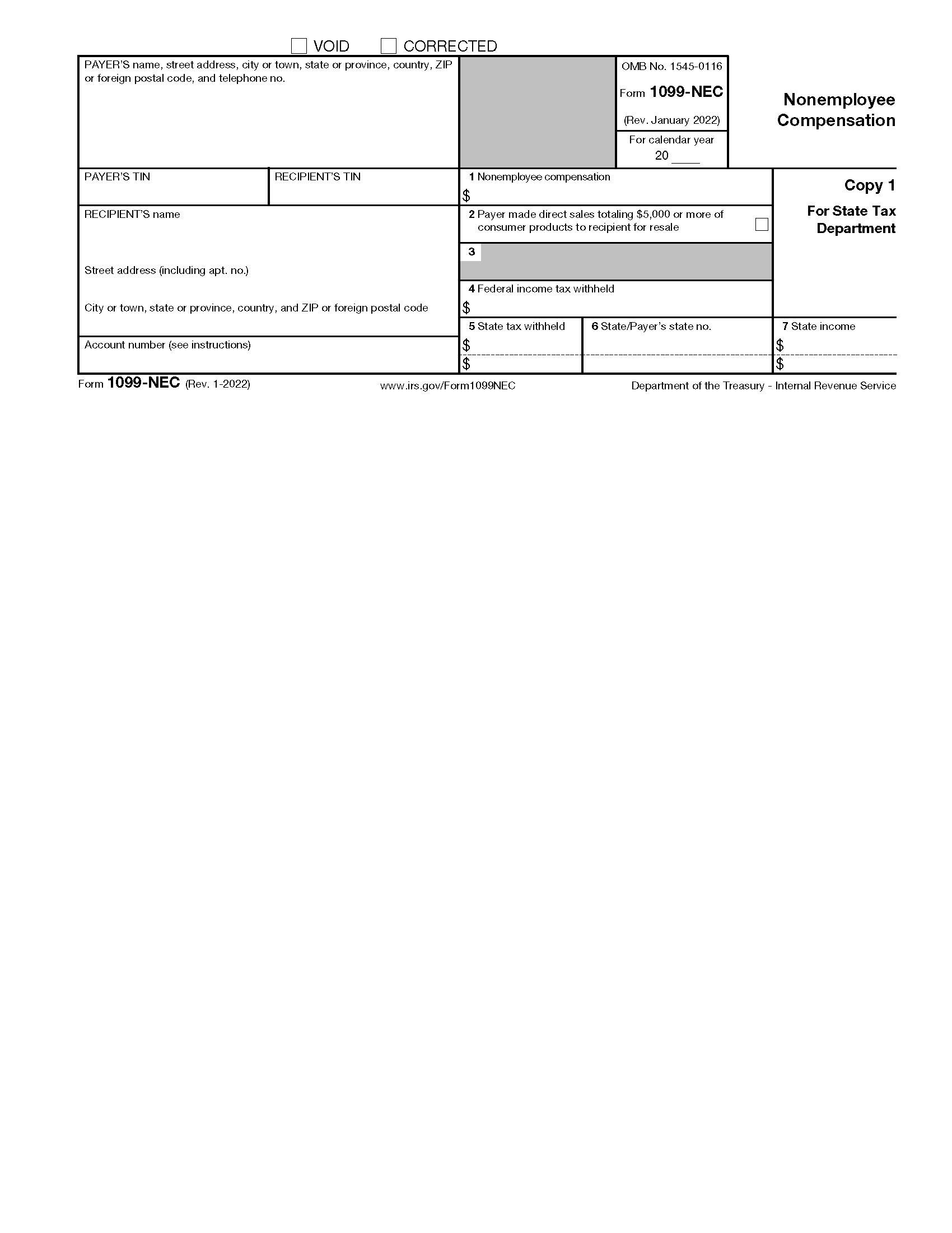

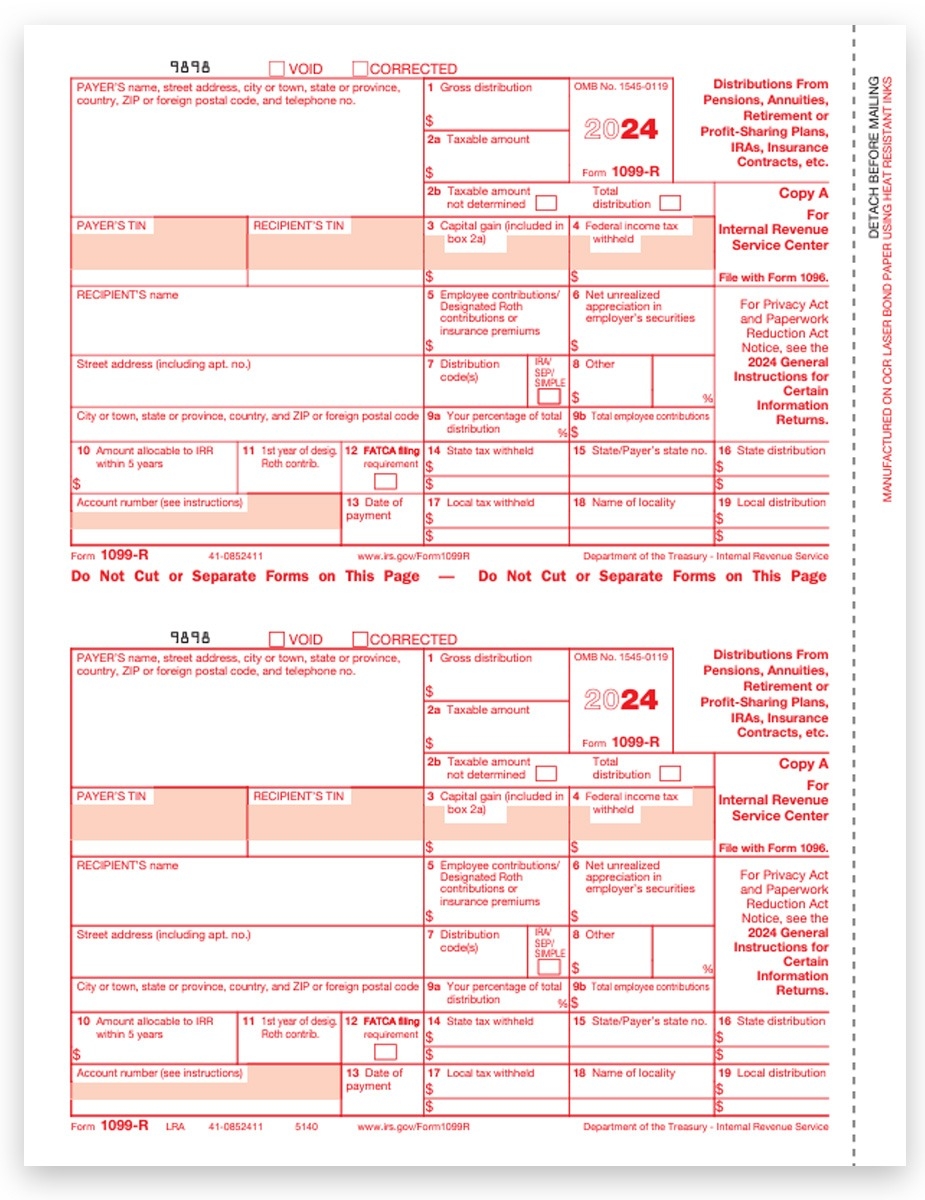

When visiting the IRS website to download federal tax forms for 2023, you will find a variety of forms tailored to different tax situations. From Form 1040 for individual income tax returns to Form 1120 for corporate tax returns, there is a form for every taxpayer’s needs. Additionally, the IRS provides instructions on how to fill out each form correctly to avoid errors and potential audits.

It’s important to note that some taxpayers may qualify for electronic filing, which can simplify the tax filing process and expedite refunds. However, if you prefer to file your taxes by mail, having access to printable federal tax forms for 2023 is essential. Make sure to double-check the forms you need based on your filing status, income level, and deductions to avoid any delays in processing your return.

In conclusion, obtaining printable federal tax forms for 2023 is a crucial step in preparing for tax season. By accessing these forms online, you can ensure that you have all the necessary documents to file your taxes accurately and on time. Whether you file electronically or by mail, having the right forms at your disposal will make the process smoother and more efficient.

Make sure to visit the IRS website to download the latest versions of federal tax forms for 2023 and stay informed about any updates or changes to tax laws that may affect your filing requirements.