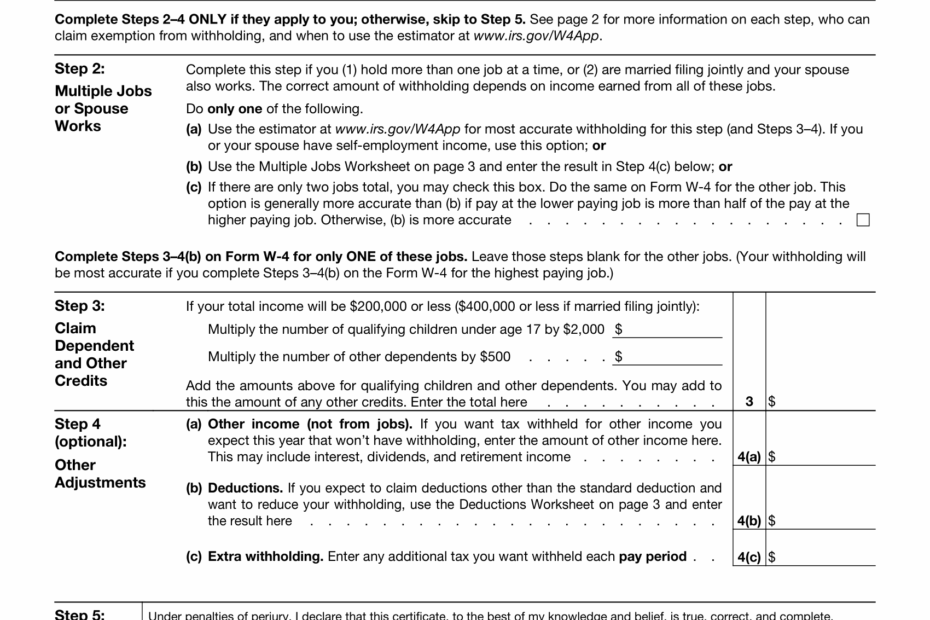

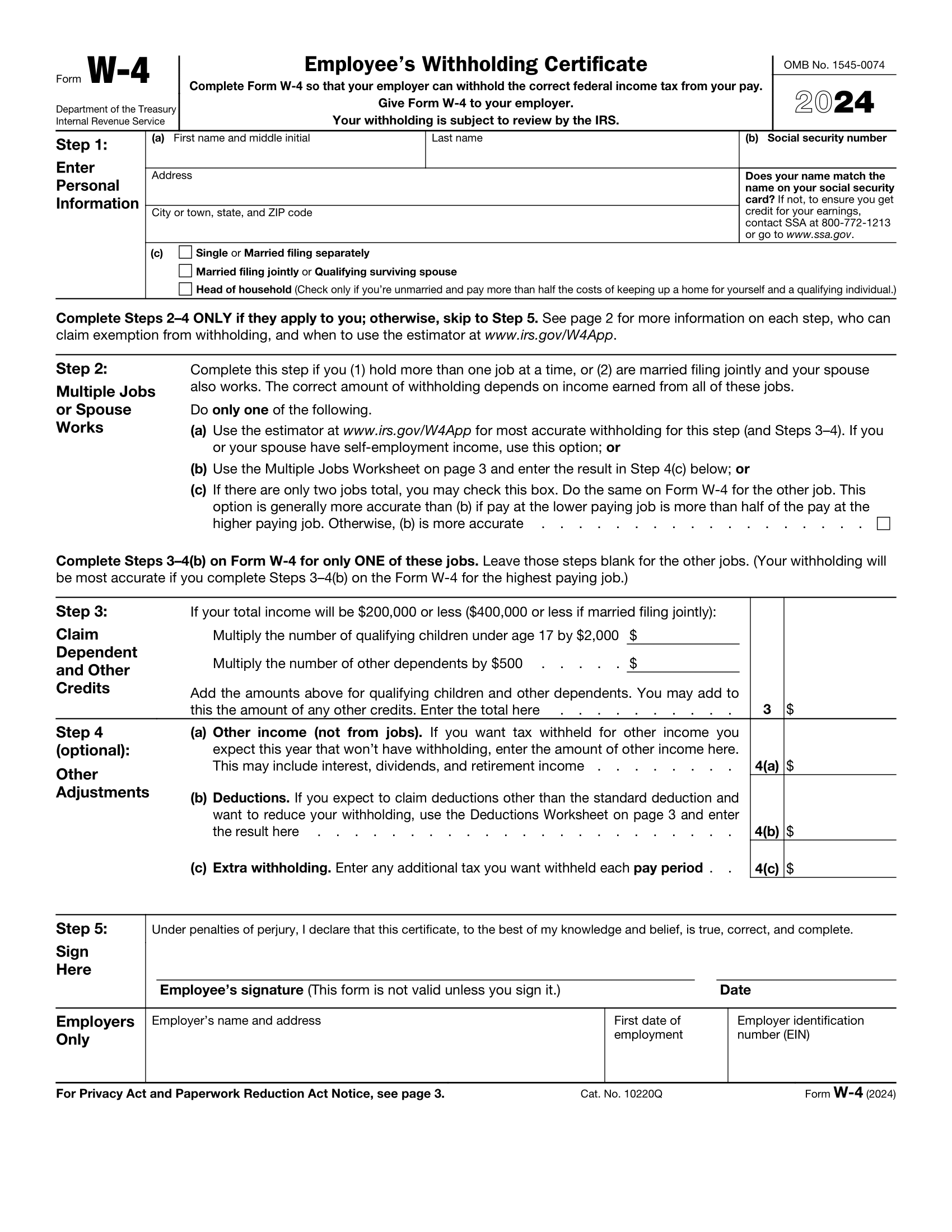

As we approach the tax season, it is important for individuals to be aware of the necessary forms they need to fill out. One such form is the W-4 form, which is used by employees to indicate their tax withholding preferences to their employers. In 2024, there will be updates to the W-4 form that individuals should be aware of.

One of the key changes to the 2024 W-4 form is the addition of new filing statuses. These new statuses will better reflect the individual’s tax situation and help ensure that the correct amount of taxes are withheld from their paychecks. It is important for individuals to carefully review these new options and select the one that best fits their circumstances.

Easily Download and Print 2024 W 4 Form Printable

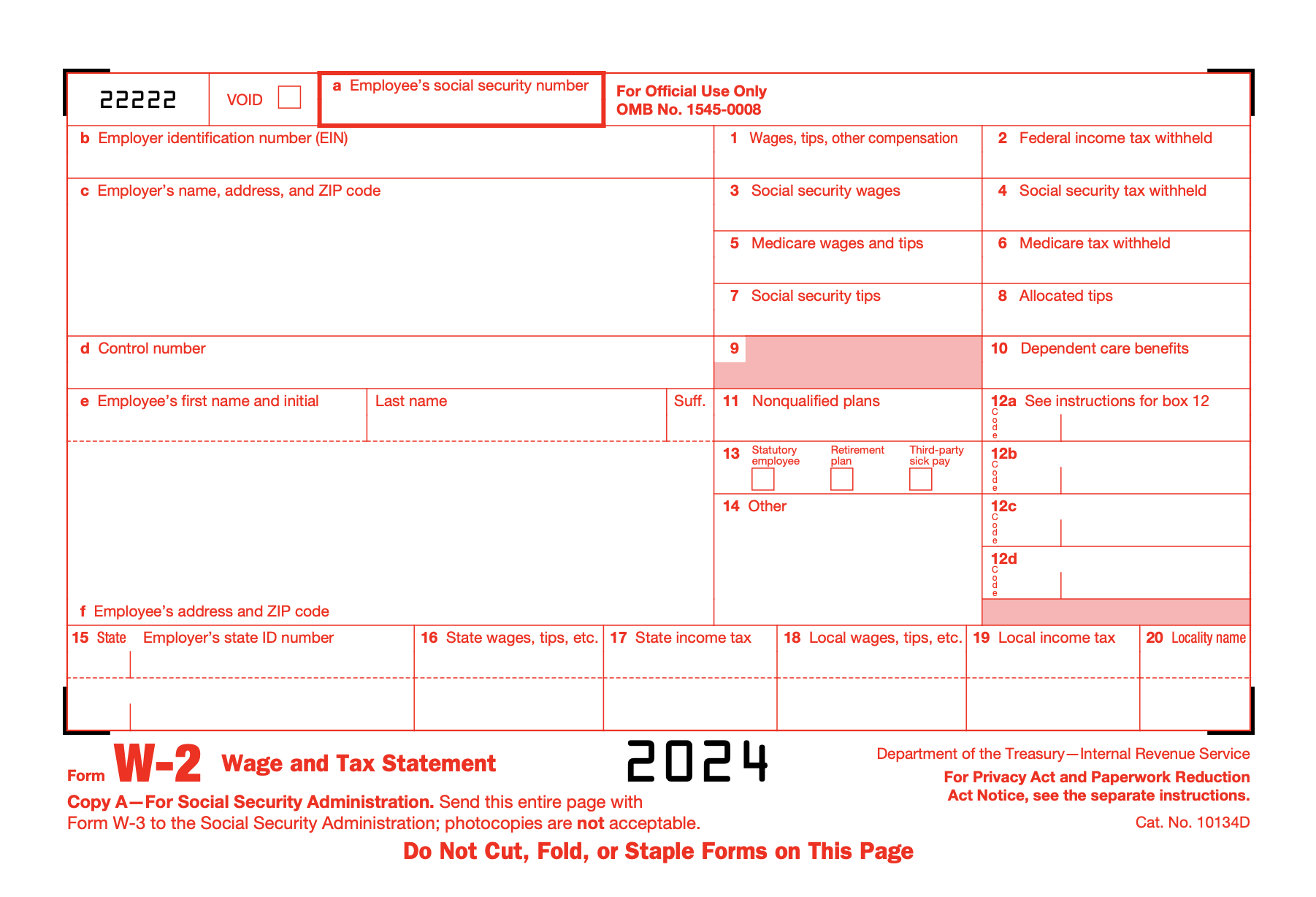

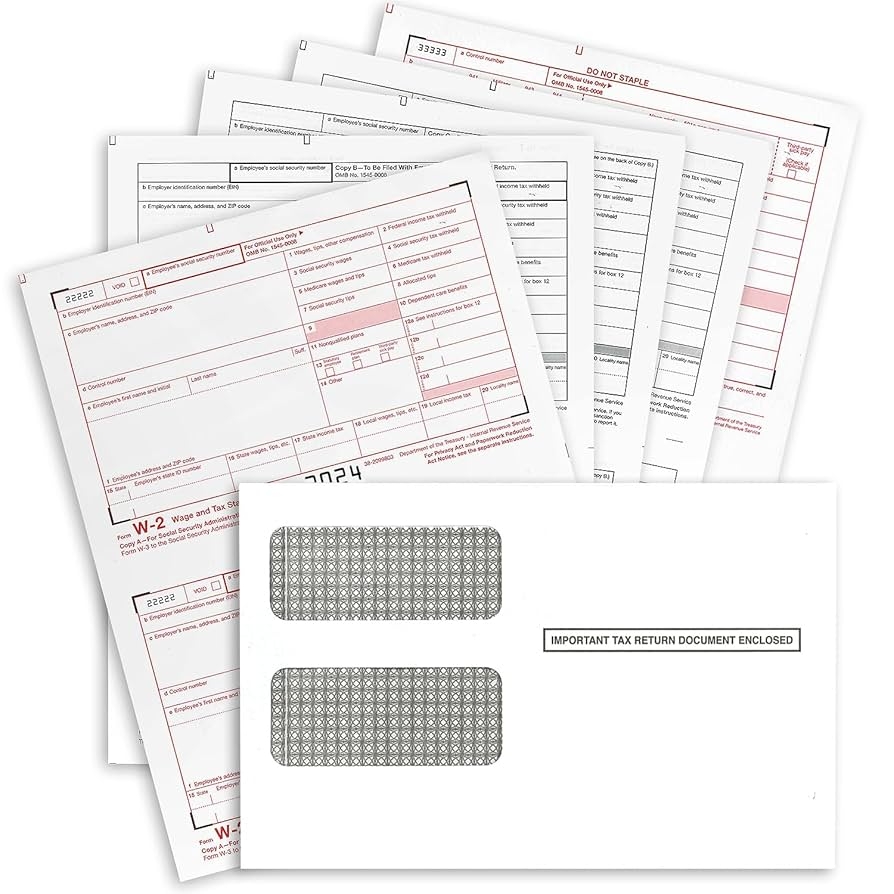

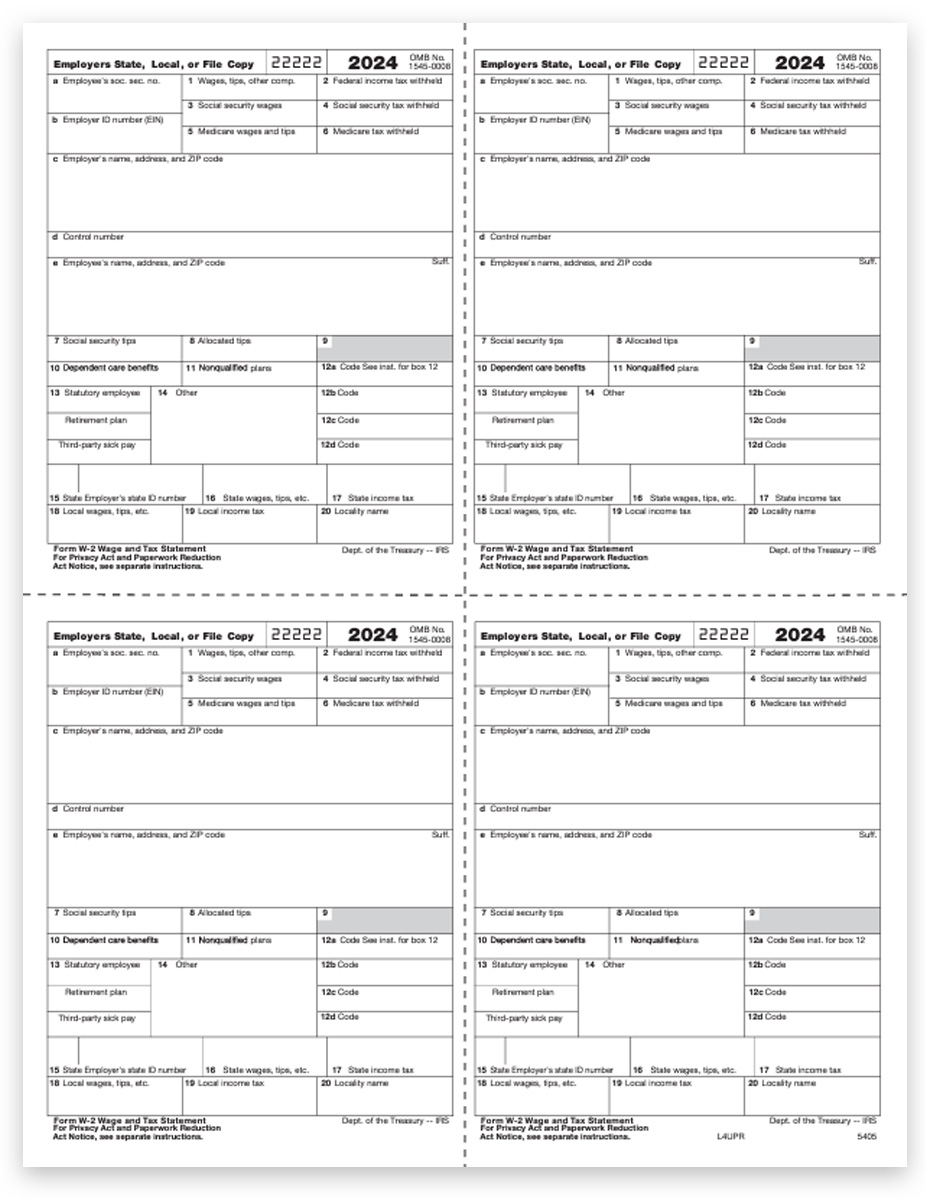

Amazon NextDayLables W2 Forms 2024 4 Part Tax Forms Set Of 50 With Self Seal Envelopes Laser Ink Jet Forms For QuickBooks And Accounting Software Office Products

Amazon NextDayLables W2 Forms 2024 4 Part Tax Forms Set Of 50 With Self Seal Envelopes Laser Ink Jet Forms For QuickBooks And Accounting Software Office Products

Additionally, the 2024 W-4 form will also include updated withholding tables. These tables will help employers calculate the amount of federal income tax to withhold from their employees’ paychecks. By using these updated tables, employers can ensure that the correct amount of taxes are withheld, reducing the likelihood of a large tax bill at the end of the year.

Another important aspect of the 2024 W-4 form is the inclusion of a section for additional income. This section will allow individuals to indicate any additional income they may have, such as interest or dividends. By providing this information, individuals can ensure that the correct amount of taxes are withheld, taking into account all sources of income.

In conclusion, the 2024 W-4 form will bring about important changes that individuals should be aware of. By understanding these updates and accurately filling out the form, individuals can ensure that the correct amount of taxes are withheld from their paychecks. It is important for individuals to stay informed and up to date on any changes to tax forms to avoid any surprises come tax time.

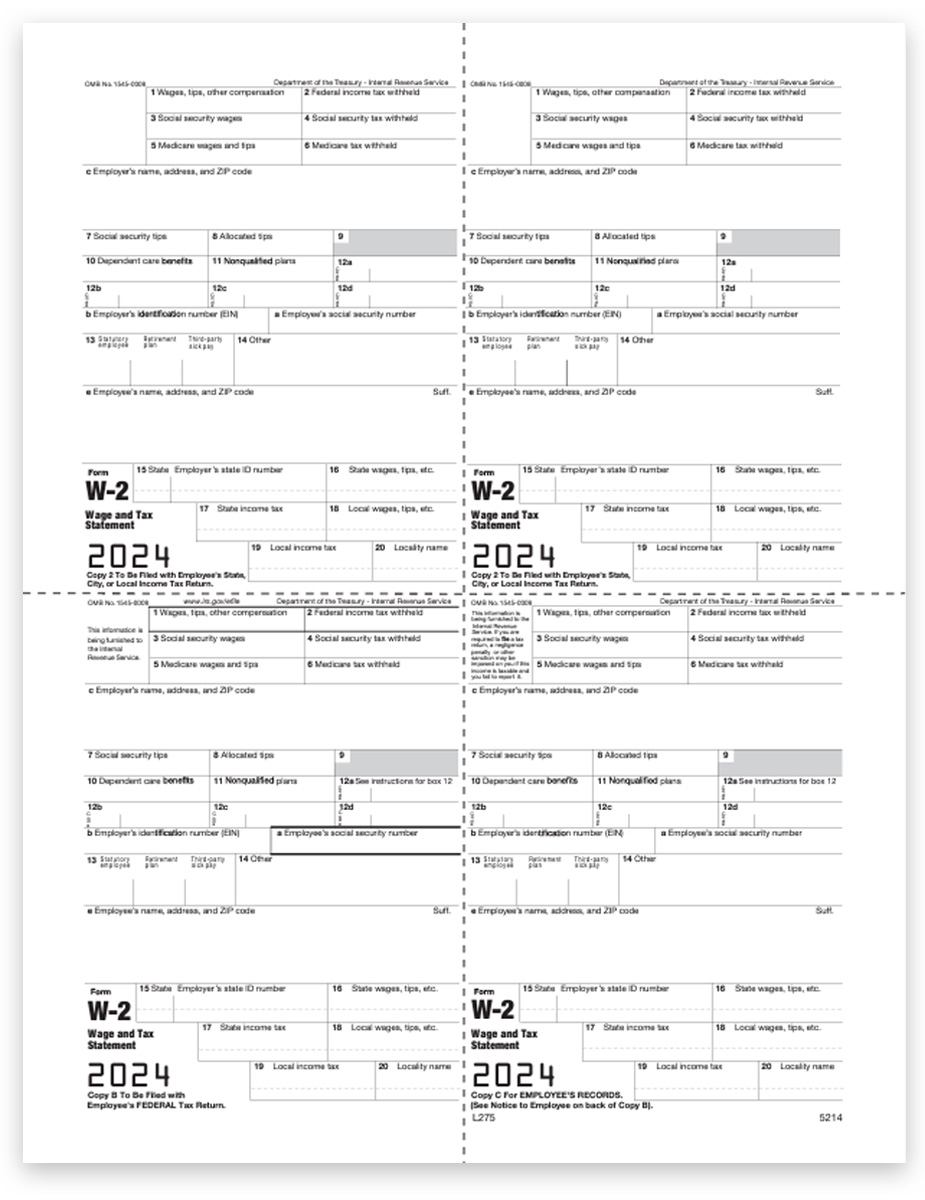

Employer W2 Tax Forms Copies 1 U0026 D 4up V1 DiscountTaxForms

Employer W2 Tax Forms Copies 1 U0026 D 4up V1 DiscountTaxForms

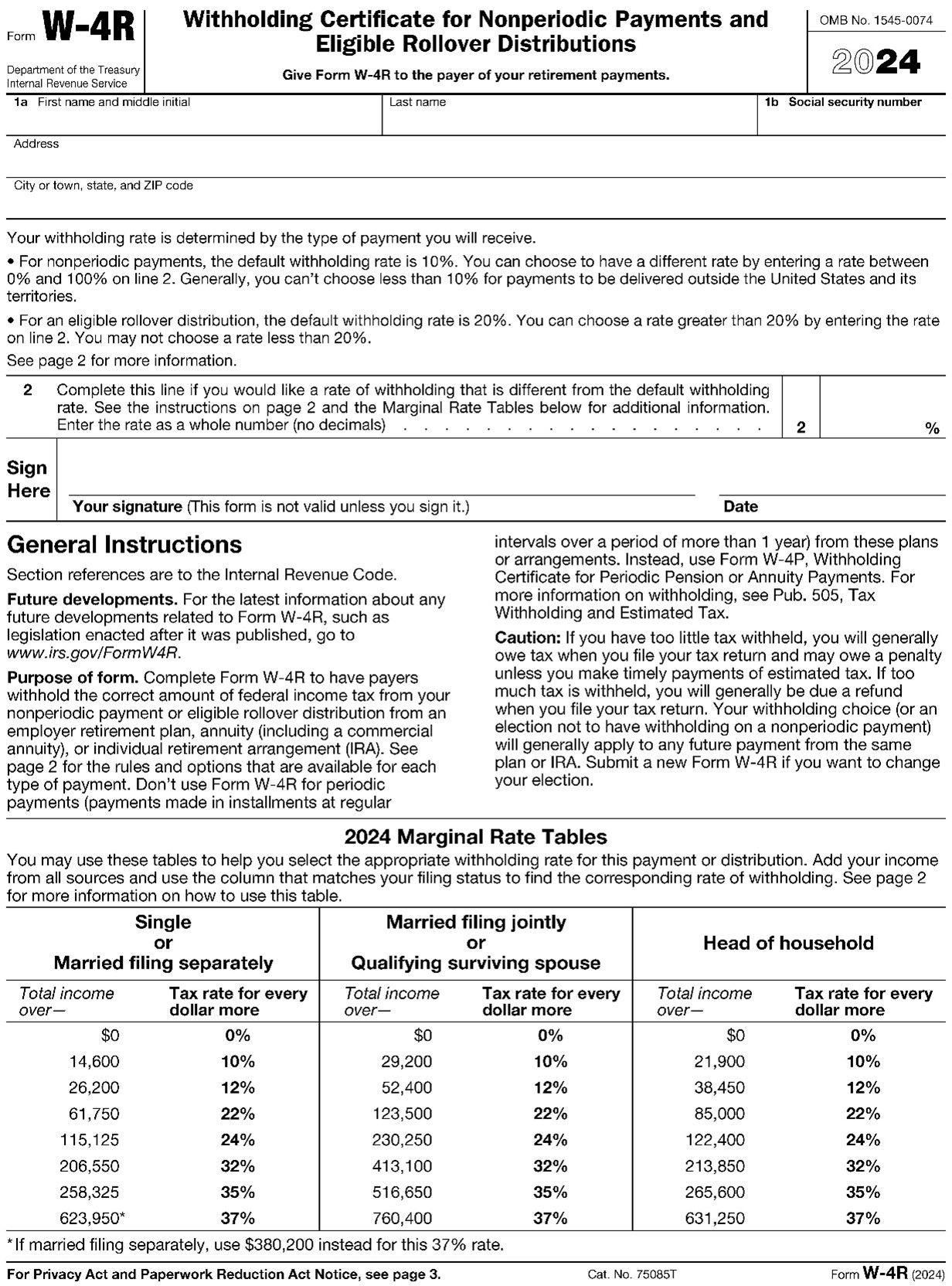

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

Employer W2 4up Tax Forms Copies 1 U0026 D Discount Tax Forms

Employer W2 4up Tax Forms Copies 1 U0026 D Discount Tax Forms

2024 IRS Form W 4 Fill Out U0026 Save With Our PDF Editor

2024 IRS Form W 4 Fill Out U0026 Save With Our PDF Editor

Looking for a simple way to take care of your financial needs? Our 2024 W 4 Form Printable give you a straightforward, secure, and editable option right from home. Perfect for individual purposes, small enterprises, or keeping track of expenses, 2024 W 4 Form Printable help you save both time and cash without lowering professionalism. Works well with common finance software and print-ready by design, they’re a smart alternative to pre-ordered checks. Start printing today and gain full control over your payments—instant access, no fees. Check out our ready-to-use templates and choose the one that matches your purpose. With our easy-to-use interface, financial management has never been this easy. Download your printable checks for free and optimize your transactions with confidence!.