As we enter a new year, it is important for businesses and individuals to stay up to date with the necessary tax forms. One such form that is commonly used is the W9 form. The W9 form is used to gather information from independent contractors, freelancers, and other self-employed individuals for tax purposes. It is essential for businesses to have a copy of the W9 form on file for each individual they work with to ensure compliance with tax laws.

One of the key benefits of having a printable W9 form is the convenience it offers. By having a printable version of the form readily available, businesses can easily provide it to individuals who need to fill it out. This eliminates the need for individuals to track down a physical copy of the form, saving time and hassle for both parties involved.

Save and Print W9 Form 2024 Printable

Free W9 Form Generator Fillable W9 By Jotform

Free W9 Form Generator Fillable W9 By Jotform

W9 Form 2024 Printable

The W9 form for 2024 is an updated version of the form that includes any changes to tax laws or regulations for the new year. It is important to use the most current version of the form to ensure accuracy and compliance with the IRS. Having a printable version of the W9 form for 2024 allows businesses and individuals to access the form quickly and easily whenever it is needed.

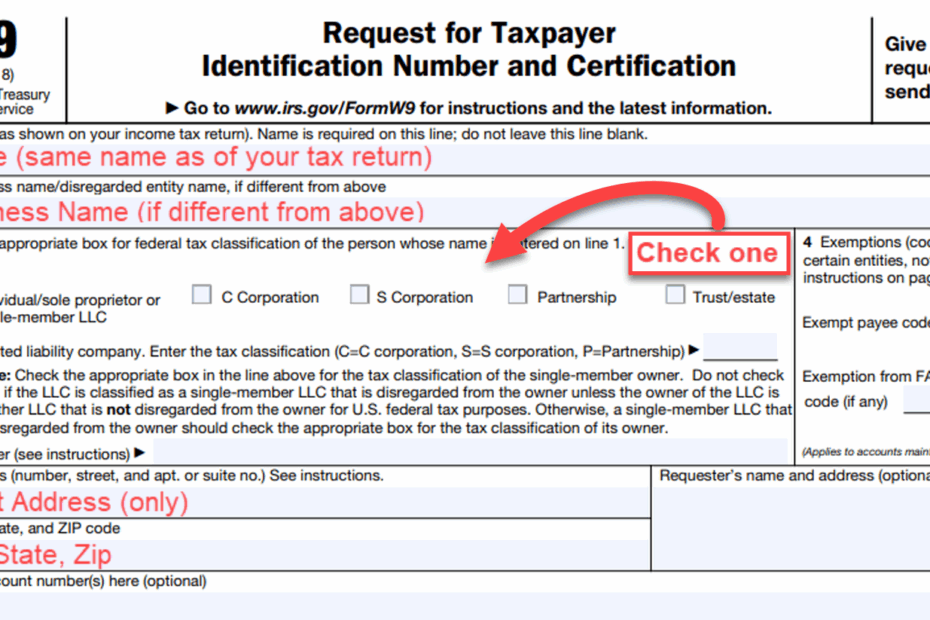

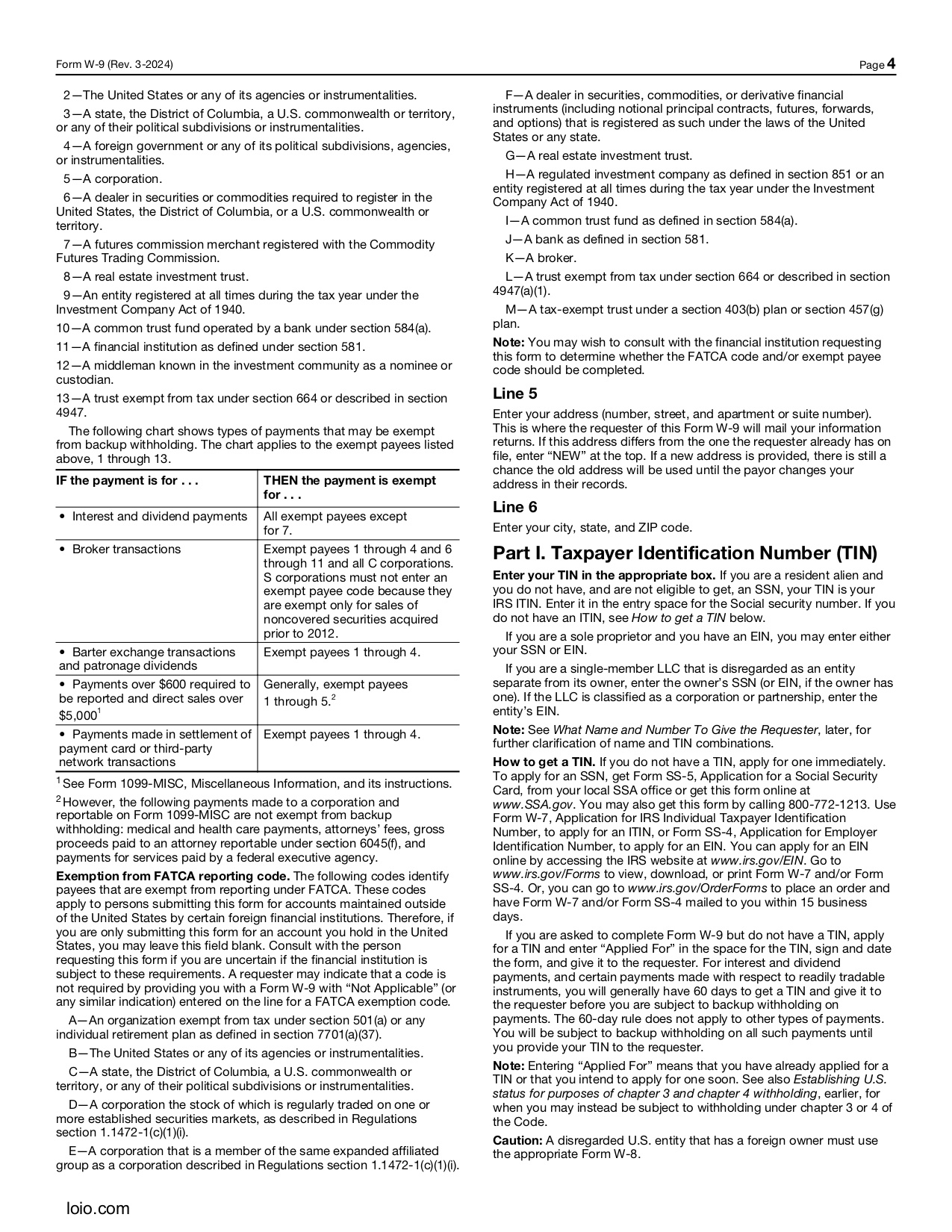

When filling out the W9 form, individuals will need to provide their name, address, taxpayer identification number (TIN), and certification of their tax status. This information is crucial for businesses to accurately report payments made to the individual to the IRS. Having a printable W9 form makes it simple for individuals to provide this information in a clear and organized manner.

In conclusion, having a printable W9 form for 2024 is essential for businesses and individuals alike. By staying up to date with the latest version of the form, businesses can ensure compliance with tax laws and accurately report payments to the IRS. With the convenience of a printable form, individuals can easily provide the necessary information to businesses in a timely manner. It is important to keep a copy of the W9 form on file for each individual worked with to avoid any potential issues during tax season.