Keeping track of your finances is essential for staying on top of your budget and expenses. One of the most effective ways to do this is by using a check book register. This simple tool allows you to record all of your transactions, including checks written, deposits made, and ATM withdrawals, in one convenient place.

While many people opt for digital banking and apps to manage their finances, some still prefer the traditional method of keeping a physical check book register. Having a printable version of a check book register can be especially useful for those who prefer to manually record their transactions or for those who want a backup in case of technology failure.

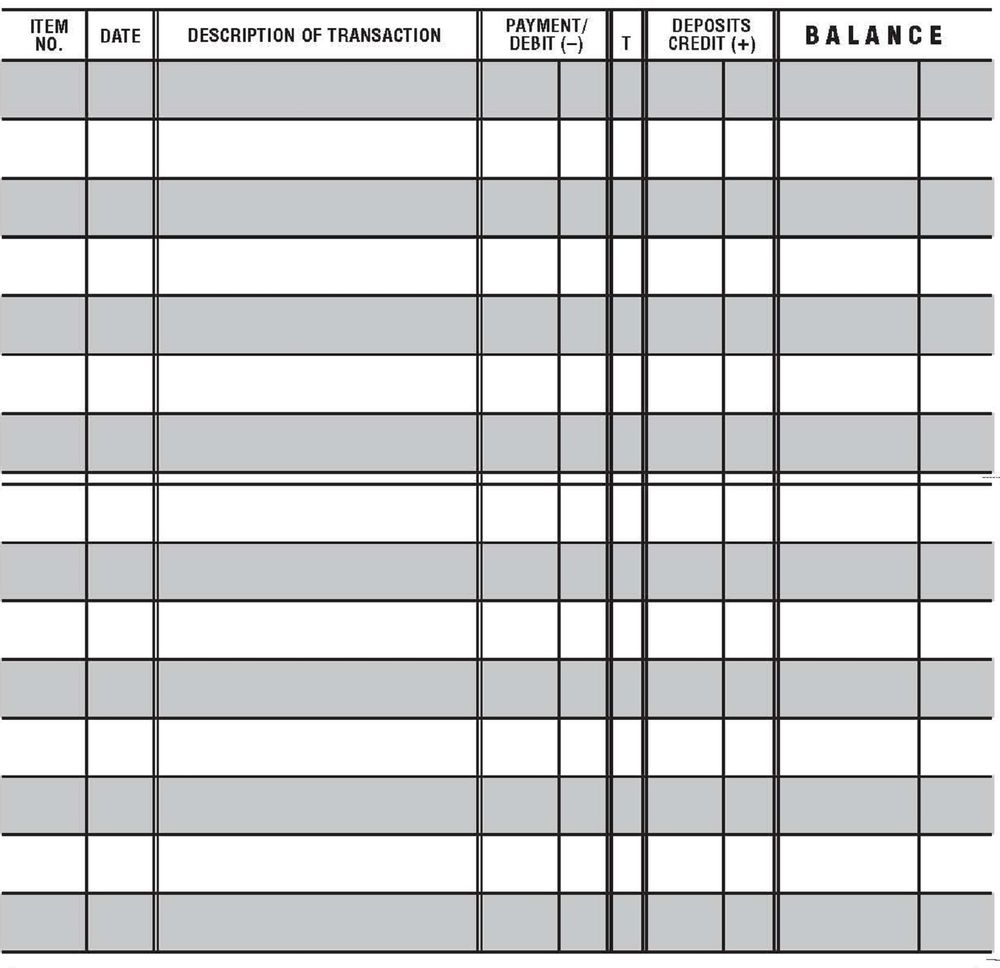

Get and Print Printable Check Book Register

Printable check book registers typically come in a simple, easy-to-use format that includes columns for the date, transaction description, check number, debit/credit amount, and balance. By filling in this information each time you make a transaction, you can easily track your spending and ensure that you are staying within your budget.

Using a printable check book register can also help you identify any discrepancies in your account, such as unauthorized transactions or bank errors. By comparing your register to your bank statements regularly, you can catch any mistakes early and take action to resolve them.

In addition to tracking your transactions, a printable check book register can also serve as a valuable tool for budgeting and financial planning. By seeing all of your expenses laid out in one place, you can identify areas where you may be overspending and make adjustments to better manage your money.

Overall, a printable check book register is a simple yet effective tool for managing your finances and staying organized. Whether you prefer to keep a physical record of your transactions or simply want a backup in case of technology failure, having a printable check book register on hand can help you stay on top of your budget and financial goals.