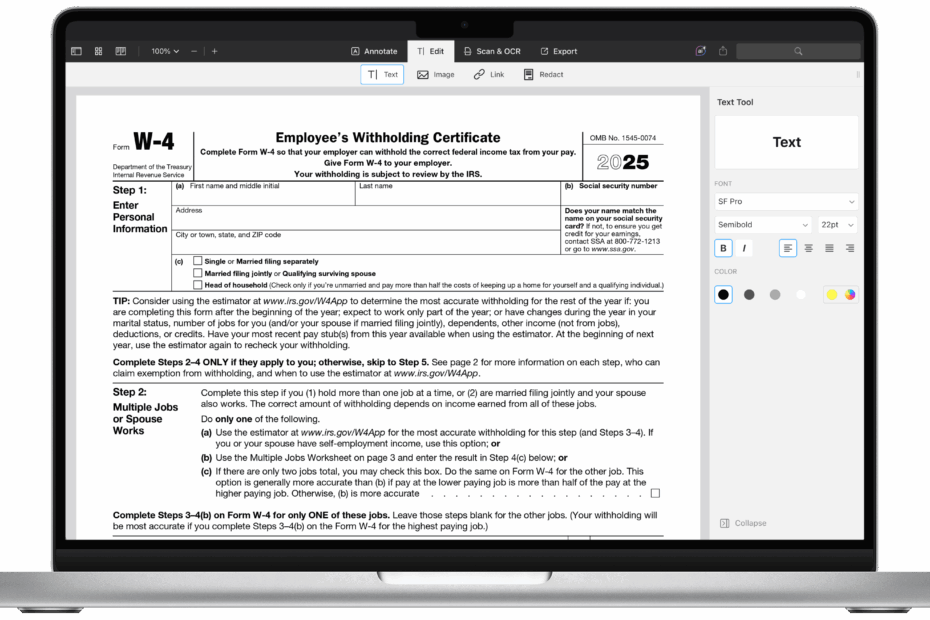

As tax season approaches, it’s important to stay organized and up-to-date with the necessary forms. The W4 form is a crucial document used by employers to determine the correct amount of federal income tax to withhold from an employee’s paycheck. In 2025, the W4 form may see updates or changes, so it’s essential to have access to the most recent version for accurate tax filing.

Having a printable version of the 2025 W4 form can make the process of filling it out much more convenient. Whether you’re starting a new job, experiencing a change in your financial situation, or just need to update your withholding information, having the form readily available can save time and ensure that you’re meeting your tax obligations.

Get and Print 2025 W4 Form Printable

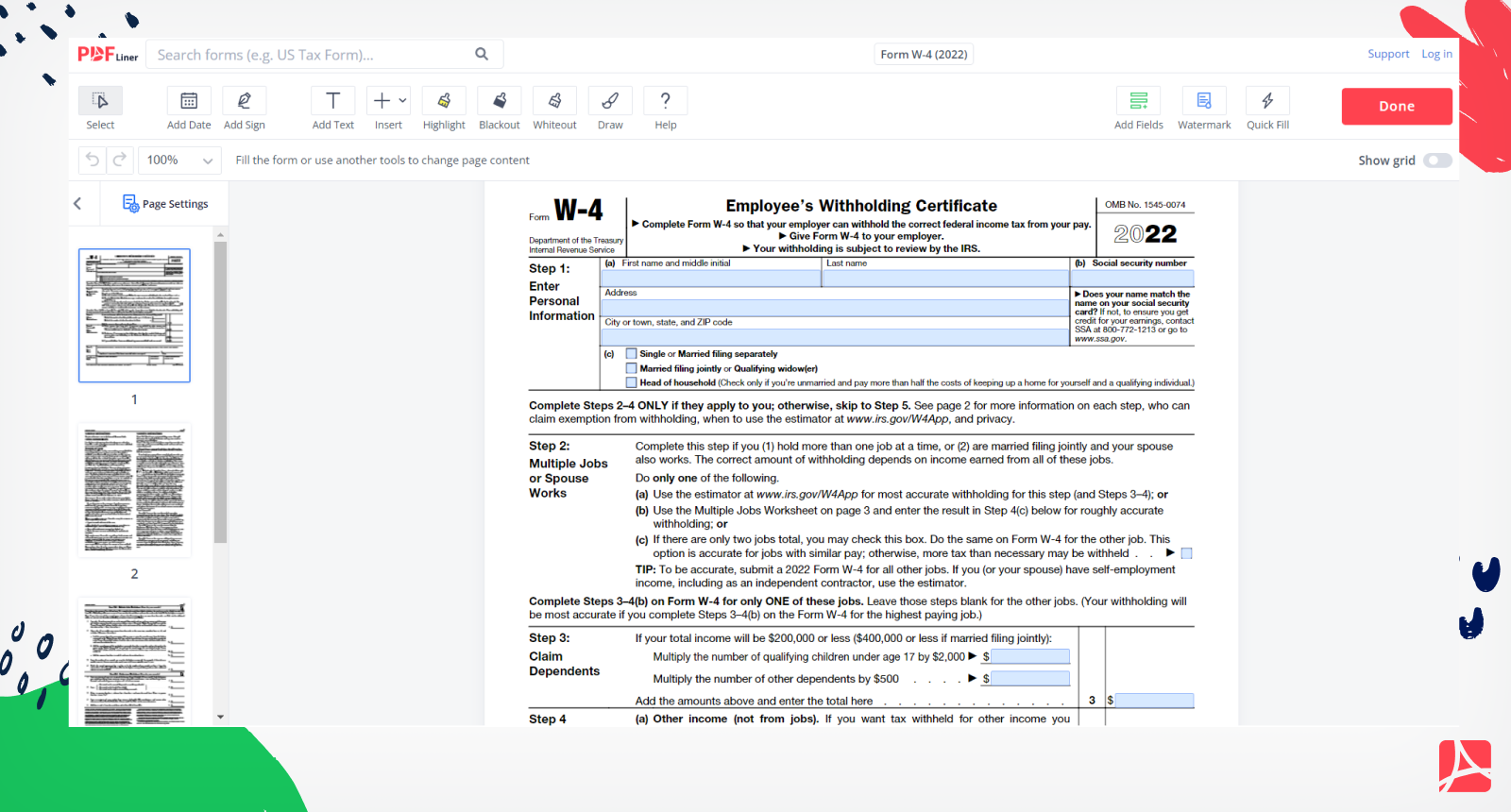

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

When it comes to filling out the 2025 W4 form, it’s important to provide accurate information to avoid potential issues with your taxes down the line. The form will typically ask for details such as your filing status, number of dependents, and any additional income you may have. By carefully completing the form and making any necessary adjustments, you can ensure that the correct amount of tax is withheld from your paycheck.

Having access to a printable version of the 2025 W4 form allows you to easily make changes as needed throughout the year. If your financial situation changes, such as getting married, having a child, or taking on a second job, you can quickly update your withholding information to reflect these adjustments. This can help prevent any surprises come tax time and ensure that you’re paying the right amount of tax throughout the year.

Overall, having a printable 2025 W4 form on hand is a valuable resource for staying compliant with your tax obligations. By keeping track of any changes in your financial situation and updating your withholding information as needed, you can avoid potential issues with under or overpaying taxes. Make sure to stay informed about any updates to the form in 2025 to ensure that you’re using the most current version for accurate tax filing.