With the year 2025 just around the corner, it’s important to start preparing for tax season ahead of time. One of the key components of tax preparation is having access to the necessary forms to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides a variety of printable forms that taxpayers can use to report their income, deductions, and credits.

As we approach 2025, it’s essential to stay informed about any changes to tax laws and regulations that may impact the forms you need to file your taxes. By familiarizing yourself with the available IRS printable forms, you can ensure that you have everything you need to complete your tax return correctly.

Get and Print 2025 Irs Printable Forms

1099 NEC Editable PDF Fillable Template 2025 With Print And

1099 NEC Editable PDF Fillable Template 2025 With Print And

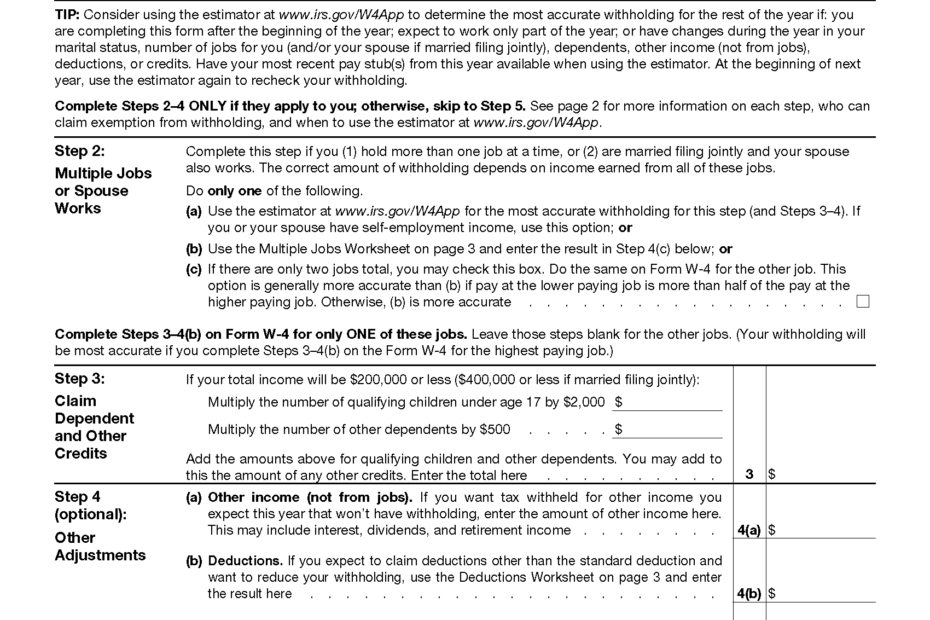

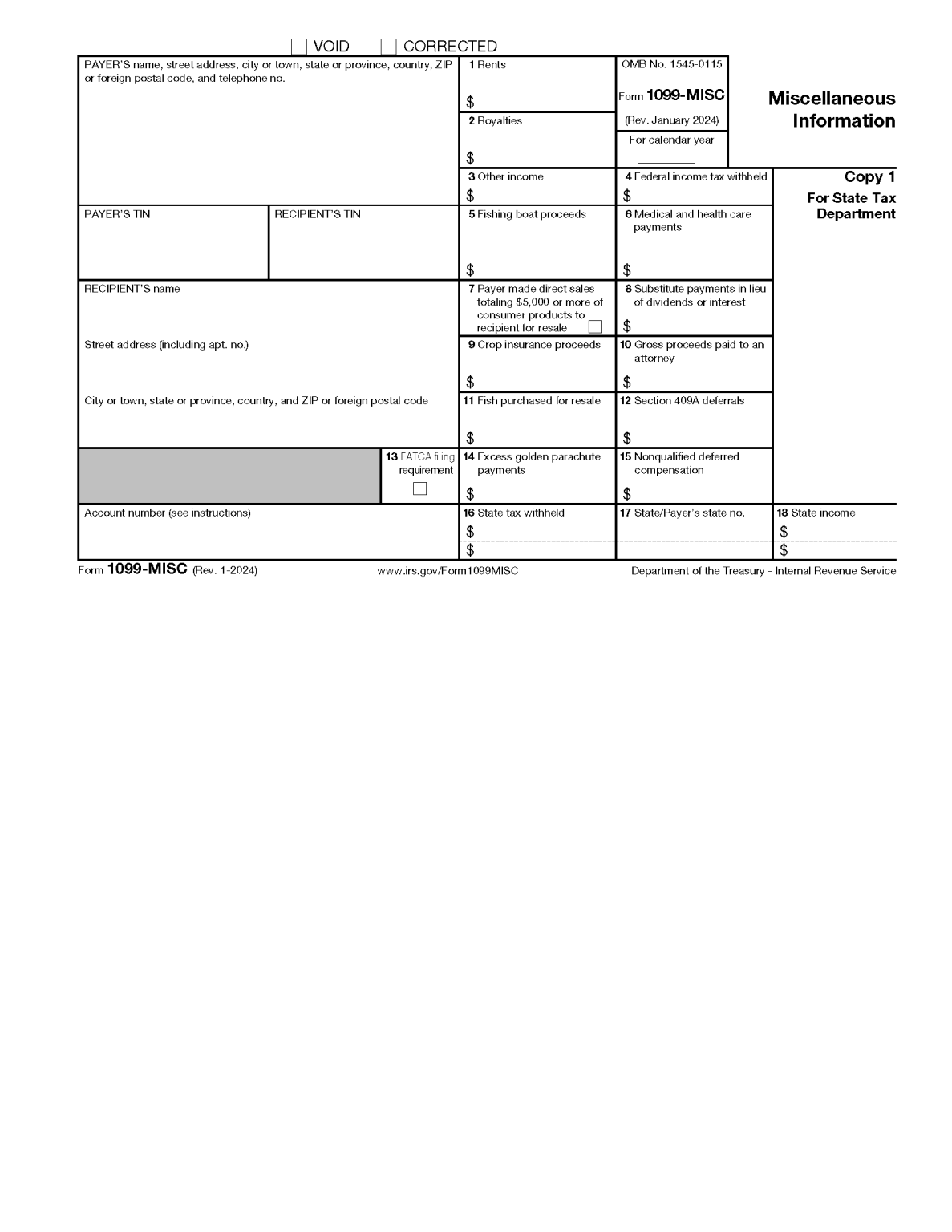

One of the most commonly used IRS printable forms is the Form 1040, which is used by individuals to report their annual income and calculate their tax liability. In addition to the Form 1040, there are a variety of other forms that may be required depending on your specific tax situation, such as Schedule A for itemized deductions or Form 8863 for education credits.

It’s important to carefully review each form and its instructions to ensure that you are providing accurate information and including all necessary documentation. Filing your taxes with incomplete or incorrect information can result in penalties and delays in processing your return.

In the year 2025, taxpayers can expect to see updates and revisions to the IRS printable forms as tax laws continue to evolve. By staying informed and using the most up-to-date forms, you can streamline the tax filing process and minimize the risk of errors on your return. Be sure to check the IRS website regularly for any updates or changes to the printable forms available for the tax year 2025.

As you prepare for the upcoming tax season in 2025, be sure to gather all necessary documentation and familiarize yourself with the IRS printable forms that you will need to file your taxes accurately. By staying organized and informed, you can make the tax filing process as smooth and efficient as possible.