In 2024, having access to printable W2 forms is essential for both employers and employees. These forms are necessary for reporting wages and taxes withheld to the IRS, ensuring that both parties are in compliance with tax laws. With the convenience of printable forms, this process becomes much easier for all involved.

Employers can easily provide their employees with printable W2 forms, allowing them to accurately report their income when filing their taxes. This streamlines the tax reporting process and ensures that employees have the necessary documentation to complete their tax returns in a timely manner.

Easily Download and Print 2024 W2 Forms Printable

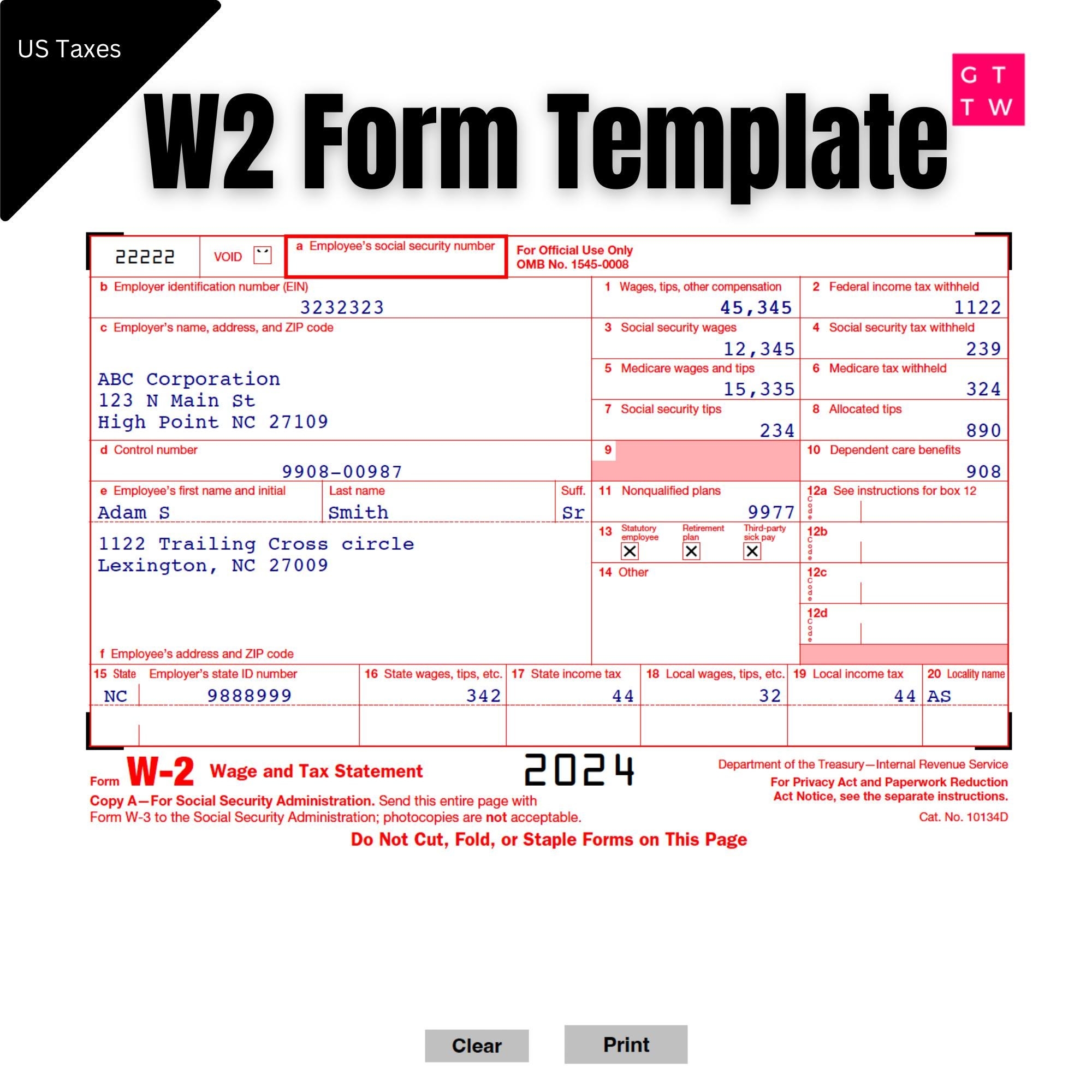

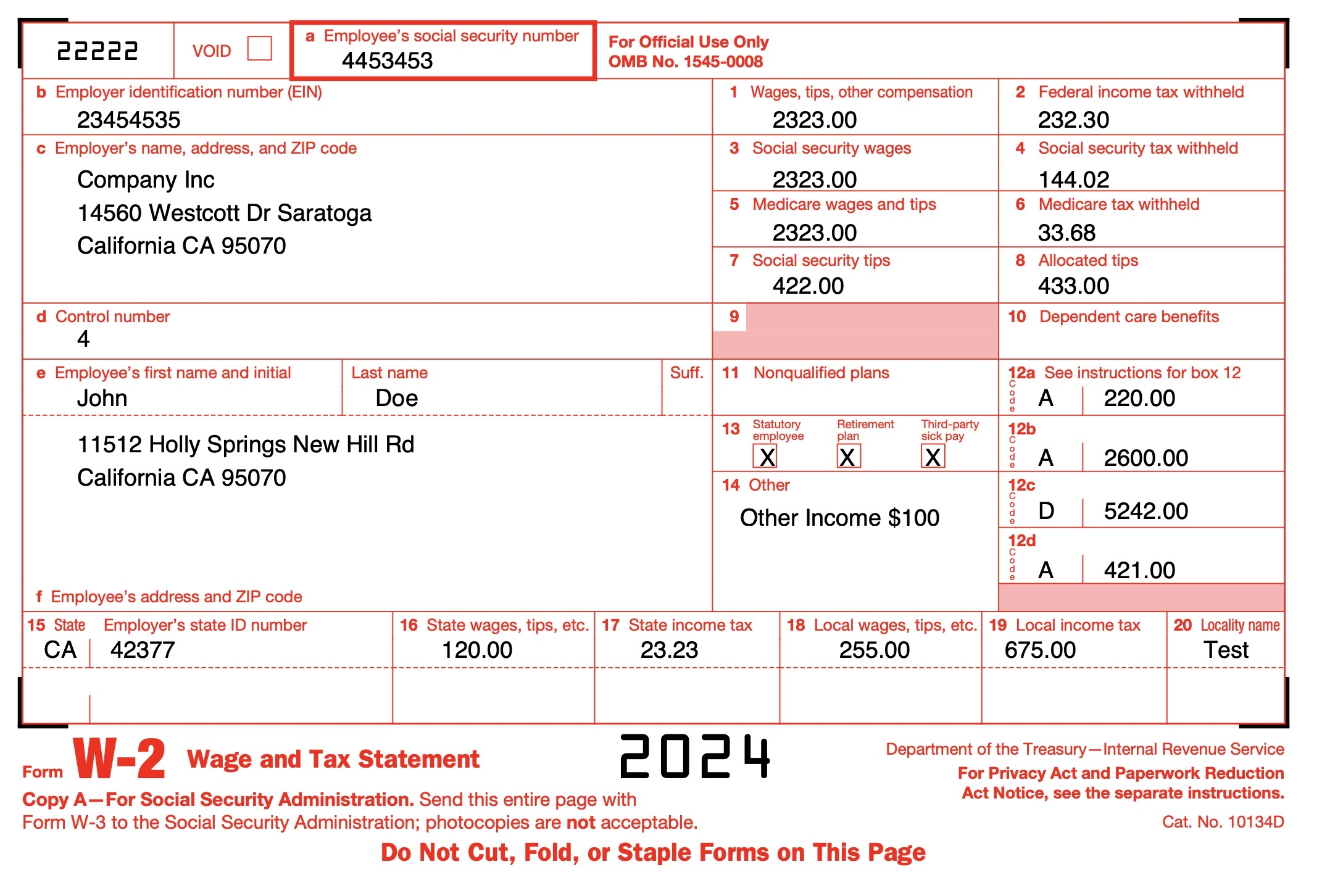

Free W2 Form Generator Create A W2 Form In One Click

Free W2 Form Generator Create A W2 Form In One Click

Additionally, printable W2 forms are beneficial for employees who may need to access their forms quickly for various reasons. Whether they are applying for a loan, seeking financial assistance, or simply need to keep records for their own personal use, having printable W2 forms readily available can be a huge help.

By utilizing printable W2 forms in 2024, both employers and employees can simplify the tax reporting process and ensure that all necessary information is accurately reported to the IRS. This can help prevent errors and delays in filing taxes, ultimately saving time and reducing the risk of penalties for non-compliance.

Overall, the availability of printable W2 forms in 2024 is a valuable resource for both employers and employees. By taking advantage of this convenient option, individuals can ensure that they are meeting their tax obligations and staying on top of their financial responsibilities. With just a few clicks, printable W2 forms can be easily accessed and utilized for a smoother tax reporting process.

As we look ahead to 2024, the use of printable W2 forms will continue to be a valuable tool for employers and employees alike. By embracing this technology and making use of printable forms, individuals can streamline their tax reporting process and ensure that all necessary information is accurately reported to the IRS.