The tax season is upon us once again, and it’s time to start thinking about filing your taxes for the year 2024. One of the most commonly used tax forms is the IRS Tax Form 1040, which is used by individuals to report their annual income and calculate their tax liability. Having access to a printable version of this form can make the process much easier and convenient.

Whether you prefer to file your taxes online or by mail, having a printable copy of the IRS Tax Form 1040 can be a valuable tool in ensuring that you accurately report your income and claim any deductions or credits that you may be eligible for. It’s important to stay organized and keep track of all necessary documents to make the filing process as smooth as possible.

2024 Irs Tax Forms 1040 Printable

2024 Irs Tax Forms 1040 Printable

Download and Print 2024 Irs Tax Forms 1040 Printable

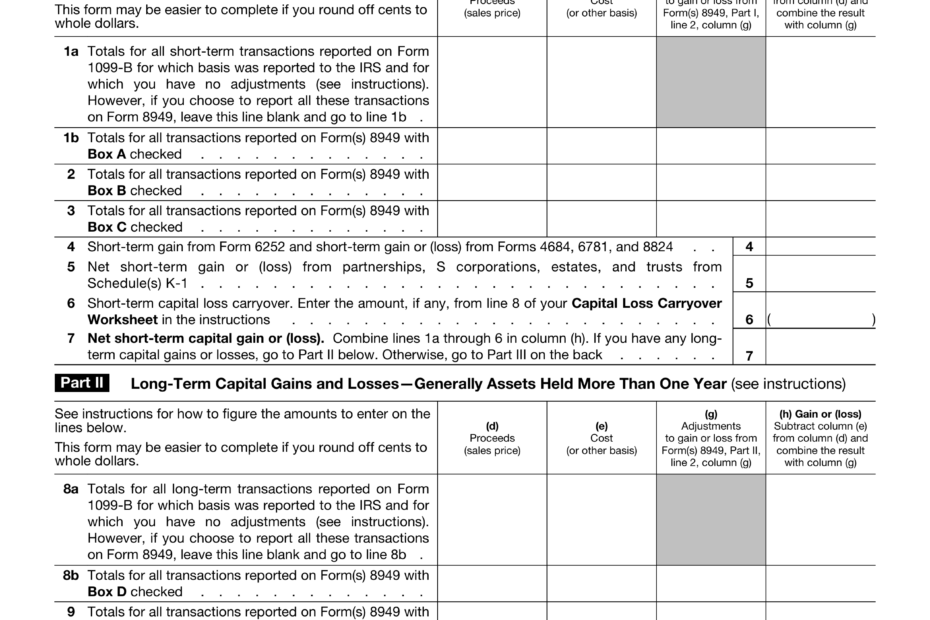

Form 1040 U0026 Schedules Simplified Instructions Tax Guide 101 Worksheets Library

Form 1040 U0026 Schedules Simplified Instructions Tax Guide 101 Worksheets Library

2024 IRS Tax Forms 1040 Printable

For the year 2024, the IRS will provide taxpayers with a printable version of the Tax Form 1040 on their official website. This form will include all the necessary fields for reporting income, deductions, credits, and tax payments. Taxpayers can also find instructions on how to fill out the form correctly to avoid any errors or delays in processing.

When using the printable IRS Tax Form 1040, it’s essential to double-check all information before submitting it to the IRS. Any mistakes or inaccuracies could result in penalties or delays in receiving any tax refunds owed to you. Utilizing resources such as tax preparation software or consulting with a tax professional can help ensure that your tax return is accurate and complete.

Remember to keep all supporting documentation, such as W-2 forms, 1099 forms, receipts for deductions, and any other relevant paperwork, when filing your taxes with the IRS. Having this information readily available will make it easier to fill out the tax form and provide accurate information to the IRS.

In conclusion, having access to the 2024 IRS Tax Form 1040 Printable can simplify the tax filing process and help ensure that you accurately report your income and claim any deductions or credits you may be eligible for. By staying organized and keeping track of all necessary documents, you can file your taxes with confidence and avoid any potential issues with the IRS.