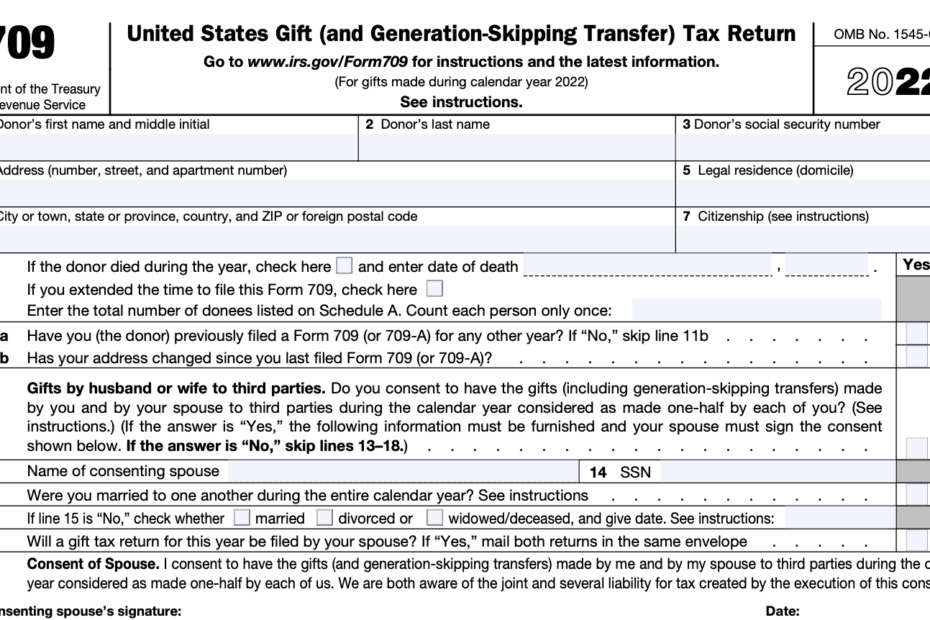

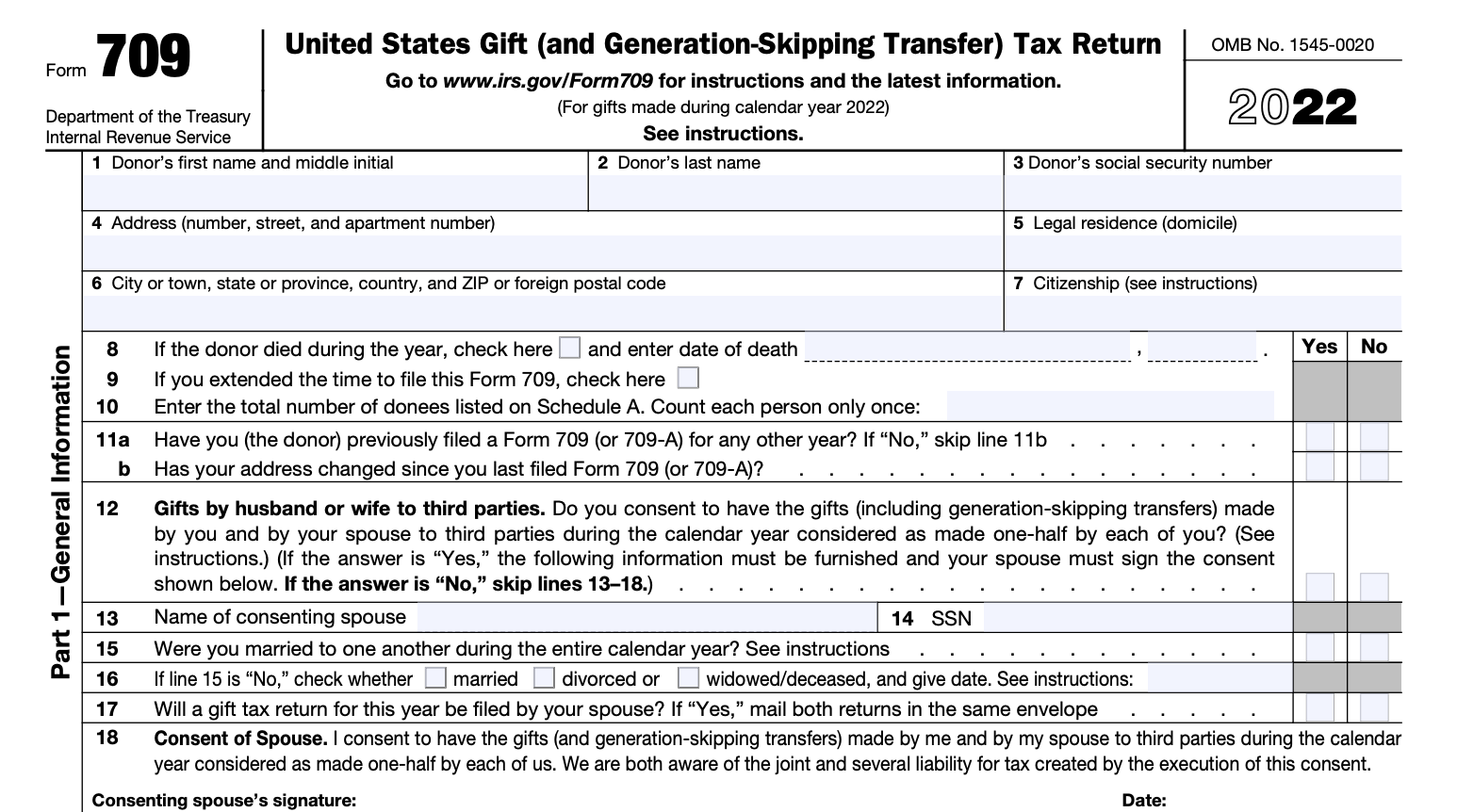

As tax season approaches, it’s important to stay up to date with the latest forms and regulations from the IRS. One such form that many individuals may need to familiarize themselves with is the IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return. This form is used to report gifts given during the tax year that exceed the annual exclusion amount set by the IRS.

For the year 2024, the IRS has released the updated Form 709 that taxpayers can use to report their gift giving activities. It is important to ensure that you are using the correct form for the tax year in question to avoid any potential issues with the IRS. The Form 709 is typically due on April 15th of the year following the tax year in question, unless an extension has been granted.

Quickly Access and Print 2024 Irs Form 709 Printable

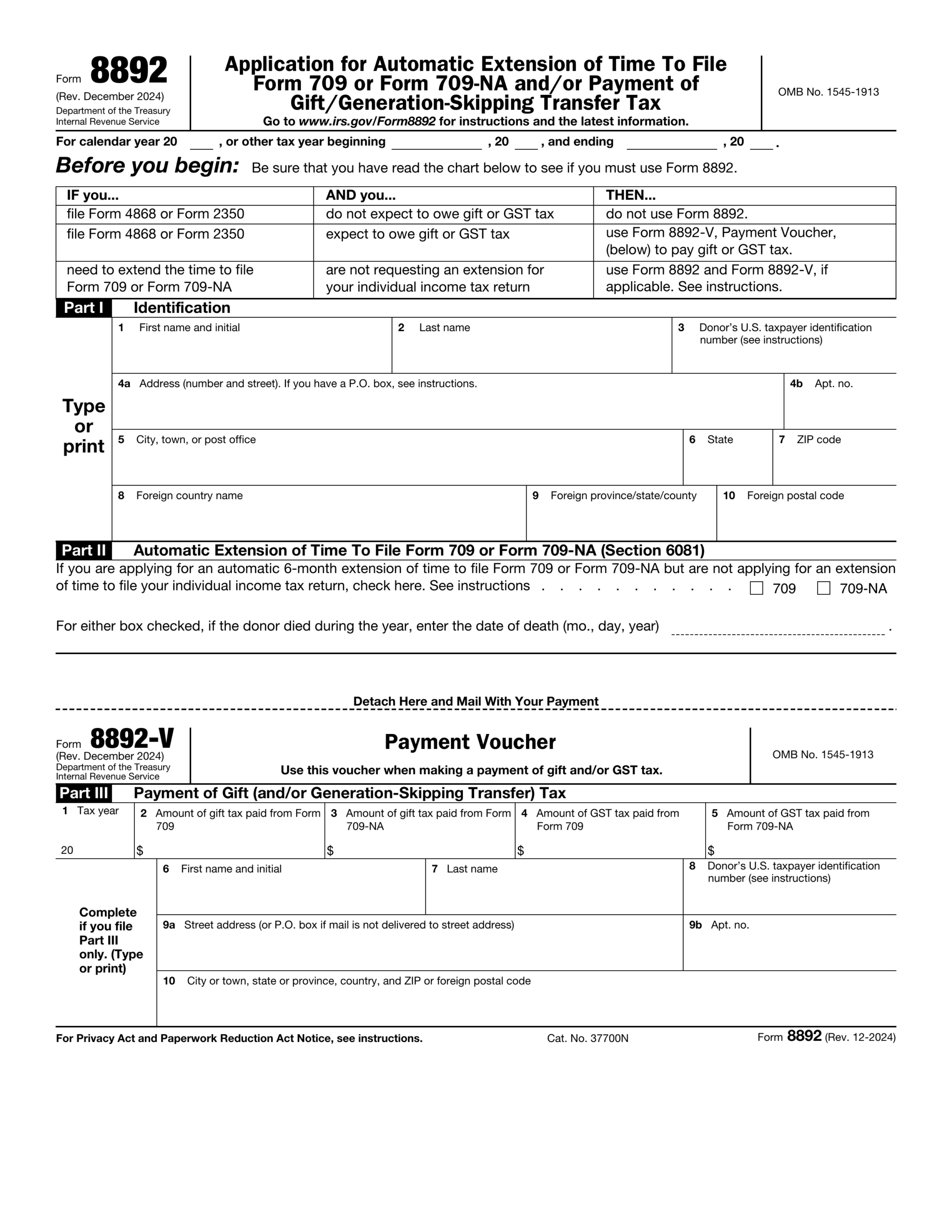

Fill Form 8892 2024 2025 Application For Extension Of Time To File

Fill Form 8892 2024 2025 Application For Extension Of Time To File

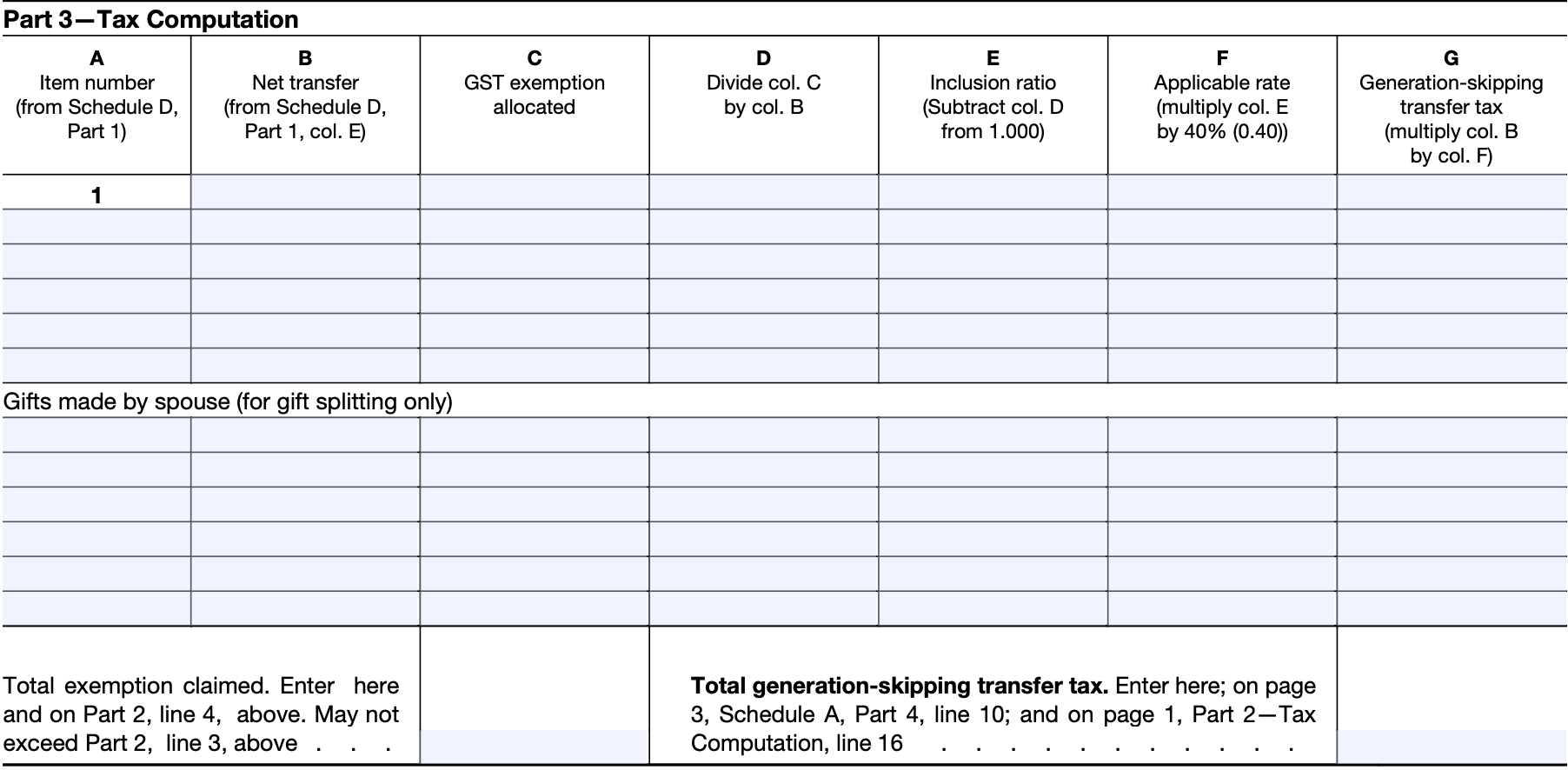

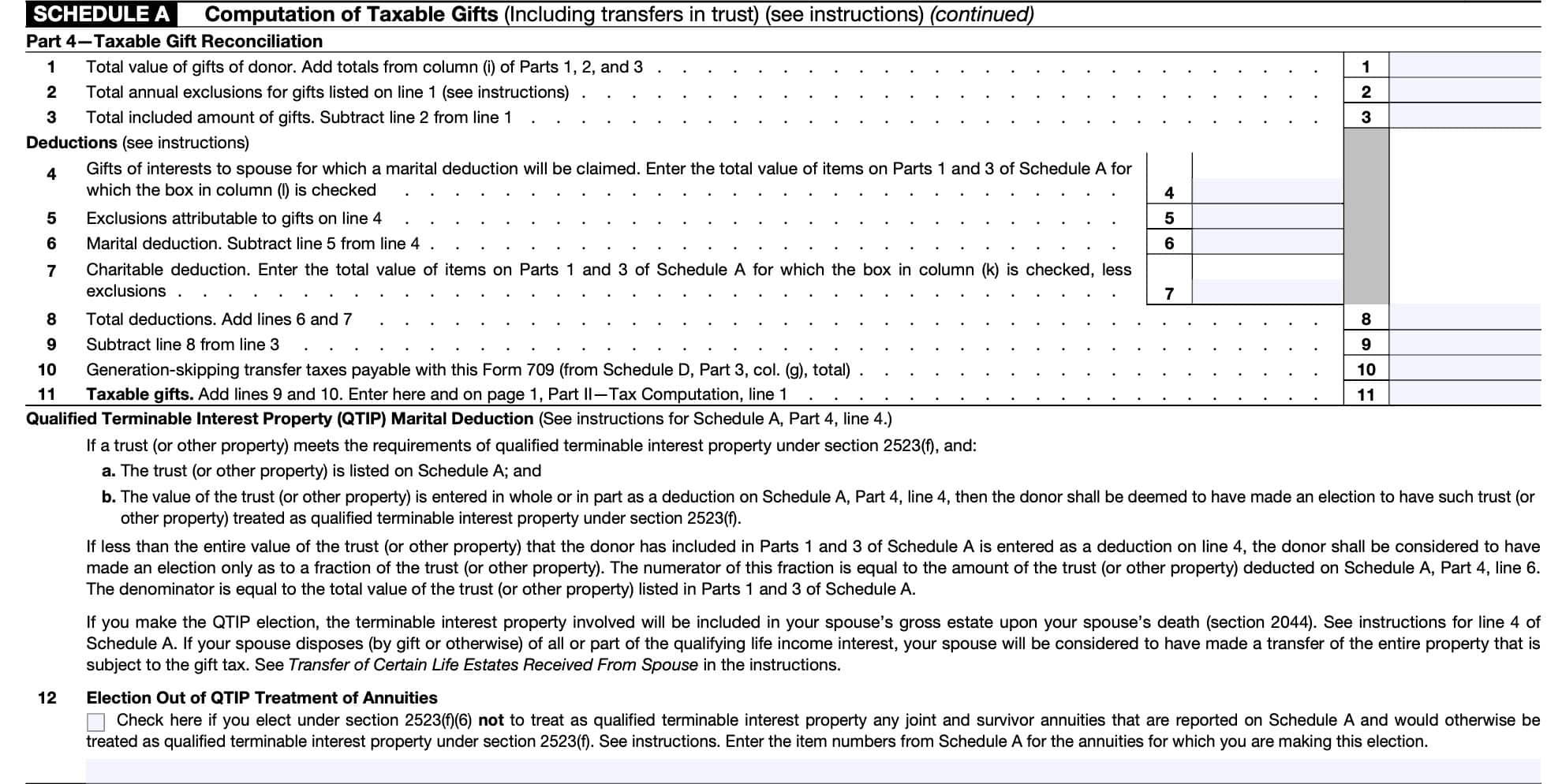

When filling out the 2024 IRS Form 709, taxpayers will need to provide detailed information about the gifts they have given throughout the year. This includes the value of the gifts, any deductions or exclusions that may apply, and information about the recipient of the gift. It is important to keep accurate records of all gifts given to ensure that the information reported on the form is correct.

In addition to reporting gifts given during the tax year, the Form 709 also allows taxpayers to allocate their lifetime gift and estate tax exemptions. This can have important implications for individuals who are looking to maximize the amount of wealth they can transfer to their heirs without incurring additional taxes. Consulting with a tax professional can help ensure that you are making the most of these exemptions.

Overall, the 2024 IRS Form 709 is an important tool for individuals who engage in gift giving activities and want to ensure compliance with IRS regulations. By staying informed about the latest forms and regulations, taxpayers can avoid potential penalties and ensure that their tax obligations are met in a timely manner.

As tax season approaches, be sure to familiarize yourself with the 2024 IRS Form 709 and consult with a tax professional if you have any questions or concerns. Taking the time to properly report your gift giving activities can help you avoid potential issues with the IRS and ensure that you are meeting your tax obligations.

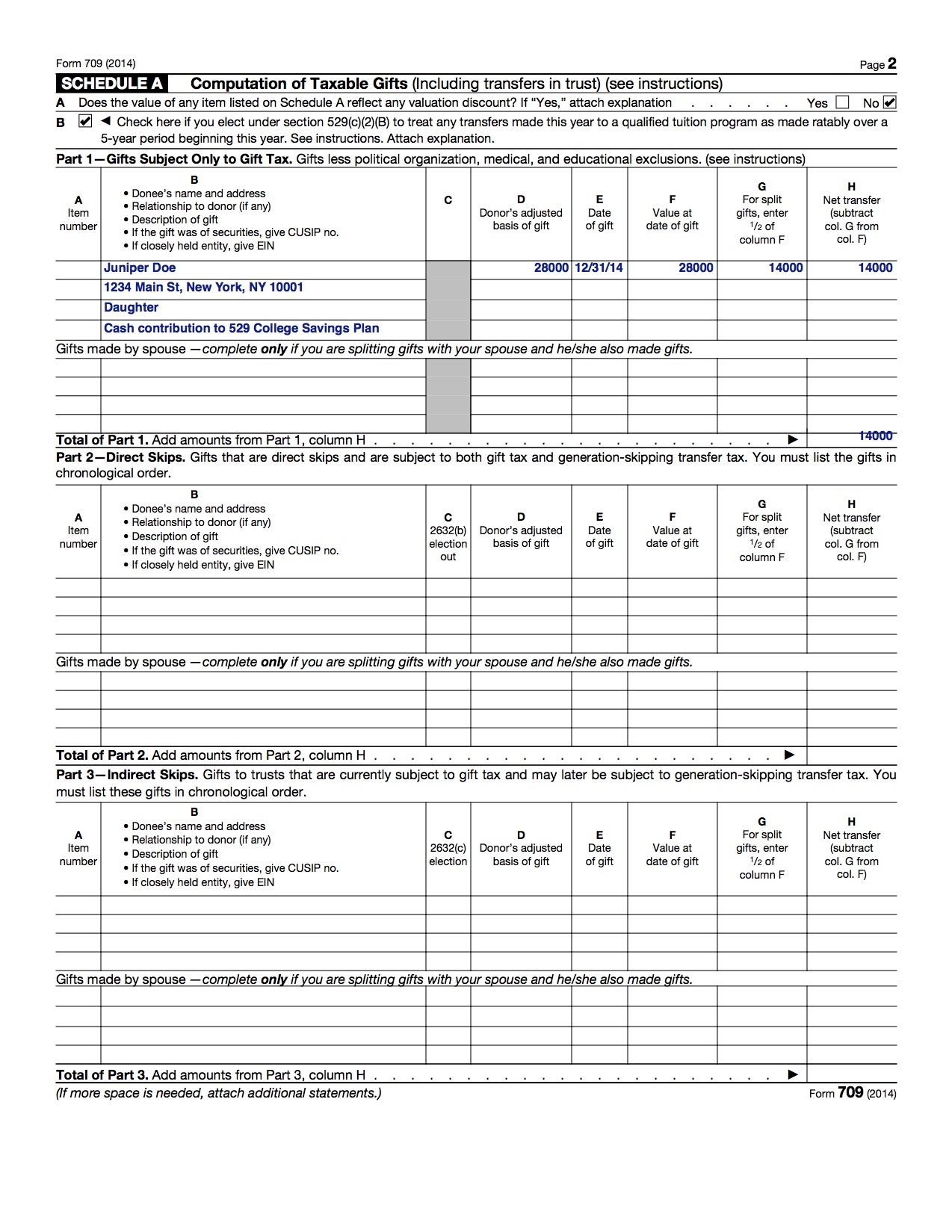

Completed Sample IRS Form 709 Gift Tax Return For 529 Superfunding Front Loading My Money Blog

Completed Sample IRS Form 709 Gift Tax Return For 529 Superfunding Front Loading My Money Blog

Need a simple solution to handle your money matters? These free printable checks give you a straightforward, safe, and editable solution from the comfort of your home. Be it for your own needs, small businesses, or budgeting, these printable checks save both time and cash without compromising quality. Supports common finance software and easy to print, they’re a smart choice to pre-ordered checks. Print your own today and fully manage your financial transactions—instant access, completely free. Explore our free templates and select the one that suits your style. With our intuitive interface, financial management has never been this easy. Access your free printable checks and streamline your transactions with security!.