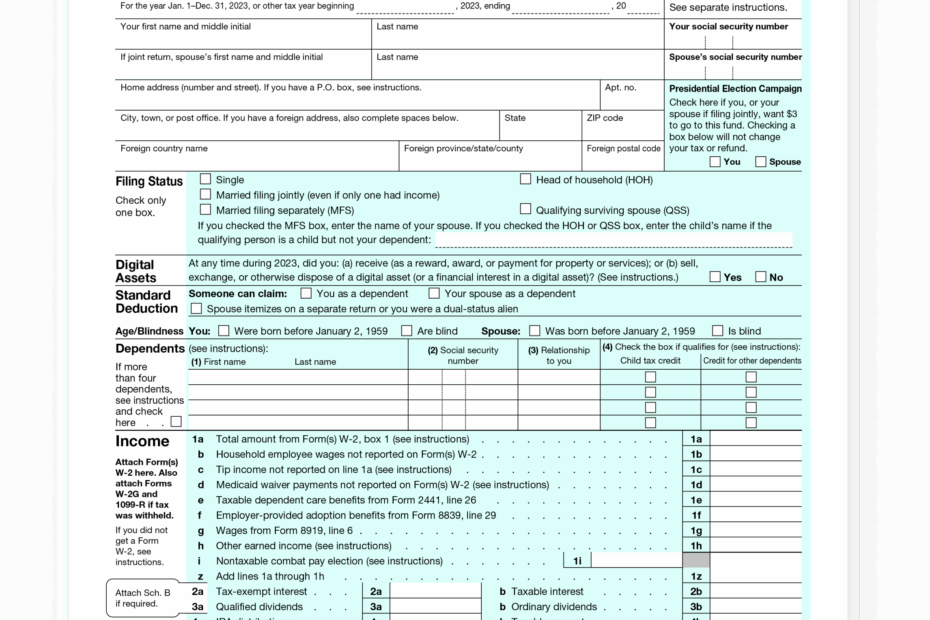

As we enter a new tax year, many individuals are starting to think about filing their taxes. One of the most important forms that taxpayers need to be familiar with is the Form 1040. This form is used by individuals to report their income, deductions, and credits to determine the amount of tax they owe or the refund they can expect.

For the year 2023, the IRS has released the updated Form 1040 that taxpayers can easily access and print. This printable form provides a convenient way for individuals to fill out their tax information and submit it to the IRS.

Easily Download and Print 2023 Form 1040 Printable

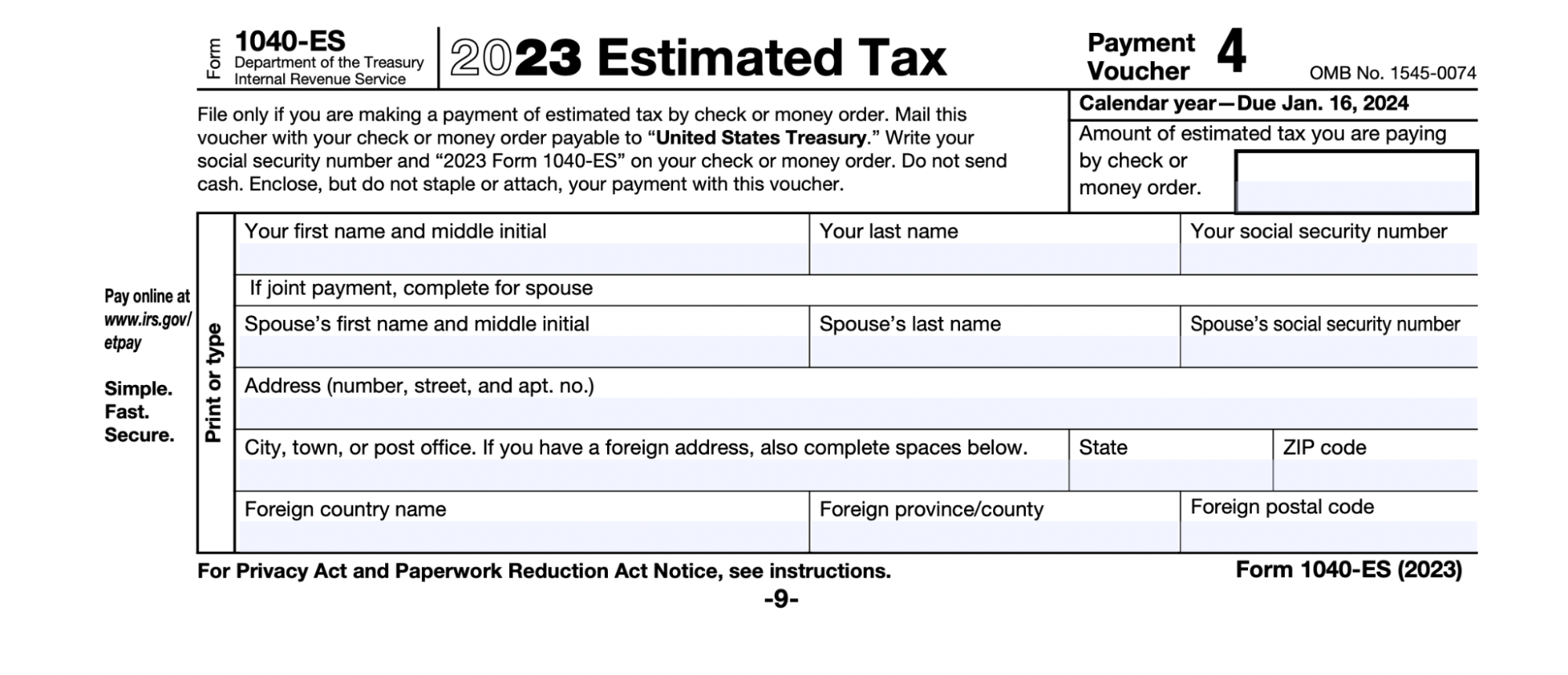

Form 1040 ES 2023 All You Need To Know FreeCashFlow Io

Form 1040 ES 2023 All You Need To Know FreeCashFlow Io

2023 Form 1040 Printable

The 2023 Form 1040 printable is a comprehensive document that includes sections for reporting income, deductions, credits, and other important tax information. Taxpayers can use this form to report various types of income, such as wages, self-employment income, interest, dividends, and more.

In addition to income, the Form 1040 also allows individuals to claim deductions for expenses such as mortgage interest, student loan interest, medical expenses, and charitable contributions. Taxpayers can also take advantage of various tax credits to reduce their overall tax liability.

It is important for individuals to carefully review and fill out the Form 1040 accurately to avoid any errors or delays in processing their tax return. The printable version of the form makes it easy for taxpayers to complete their tax information neatly and legibly.

Once the Form 1040 is filled out, taxpayers can either mail it to the IRS or file electronically using tax preparation software or online services. By submitting their tax return on time and accurately, individuals can ensure that they are in compliance with their tax obligations and avoid any penalties or interest charges.

In conclusion, the 2023 Form 1040 printable is a valuable tool for individuals to report their income and deductions accurately to the IRS. By using this form, taxpayers can streamline the tax filing process and ensure that they are meeting their tax obligations in a timely manner.