As tax season approaches, many individuals are gearing up to file their income taxes for the year 2022. One of the key components of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits. Fortunately, the Internal Revenue Service (IRS) provides printable versions of these forms on their website for easy access.

Whether you are a salaried employee, self-employed individual, or business owner, having the right tax forms is essential to ensuring compliance with federal tax laws. By utilizing the printable forms provided by the IRS, you can effectively report your financial information and avoid any potential penalties for inaccuracies or omissions.

2022 Income Tax Forms Printable

2022 Income Tax Forms Printable

Easily Download and Print 2022 Income Tax Forms Printable

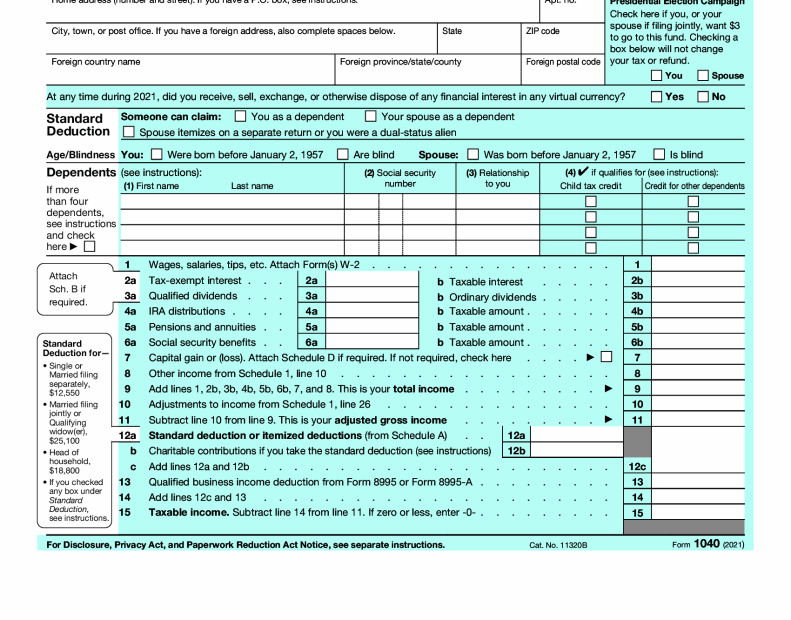

When accessing the IRS website for 2022 income tax forms, you will find a variety of options to suit your specific tax situation. From Form 1040 for individual tax returns to Form 1120 for corporate tax filings, there is a form available for every taxpayer. Additionally, the IRS offers instructions for each form to guide you through the reporting process.

It is important to note that some taxpayers may qualify for free filing options through the IRS website, which can streamline the tax preparation process and eliminate the need for paper forms altogether. By utilizing electronic filing methods, you can expedite the processing of your tax return and receive any refunds in a timelier manner.

In conclusion, obtaining and using the 2022 income tax forms printable from the IRS is essential for accurately reporting your financial information and fulfilling your tax obligations. By taking advantage of these resources, you can ensure compliance with federal tax laws and avoid any potential penalties for errors in your tax return. Be sure to visit the IRS website to access the necessary forms for your tax filing needs.