As the tax season approaches, it is essential to be prepared with all the necessary forms and information to file your taxes accurately and on time. One such form is the 2018 1040a Income Tax Printable Form, which is used by individuals with simple tax situations to report their income, deductions, and credits.

Completing your taxes can be a daunting task, but having the right forms at your disposal can make the process much smoother. The 2018 1040a form is designed for taxpayers who have income from wages, salaries, tips, interest, and dividends, and who do not itemize deductions or claim any adjustments to income.

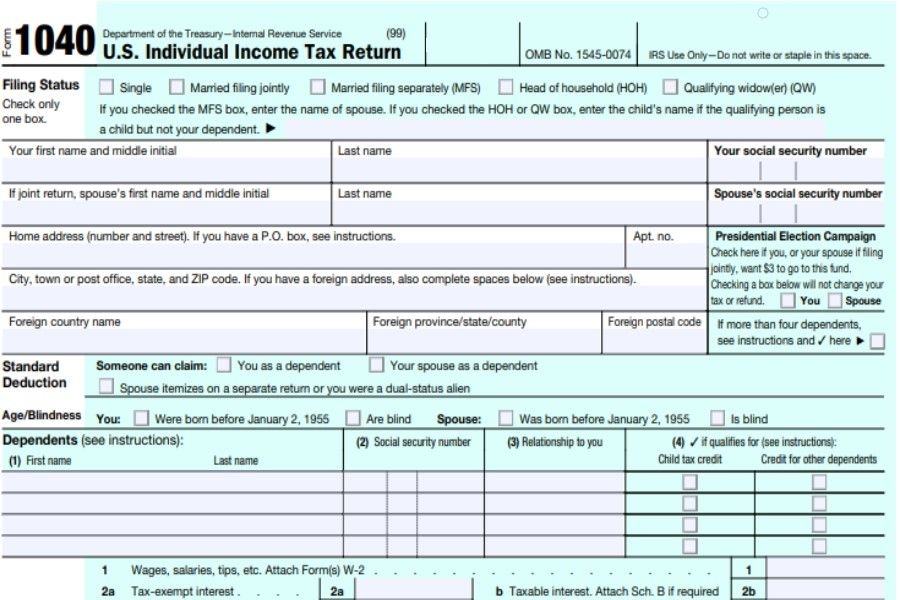

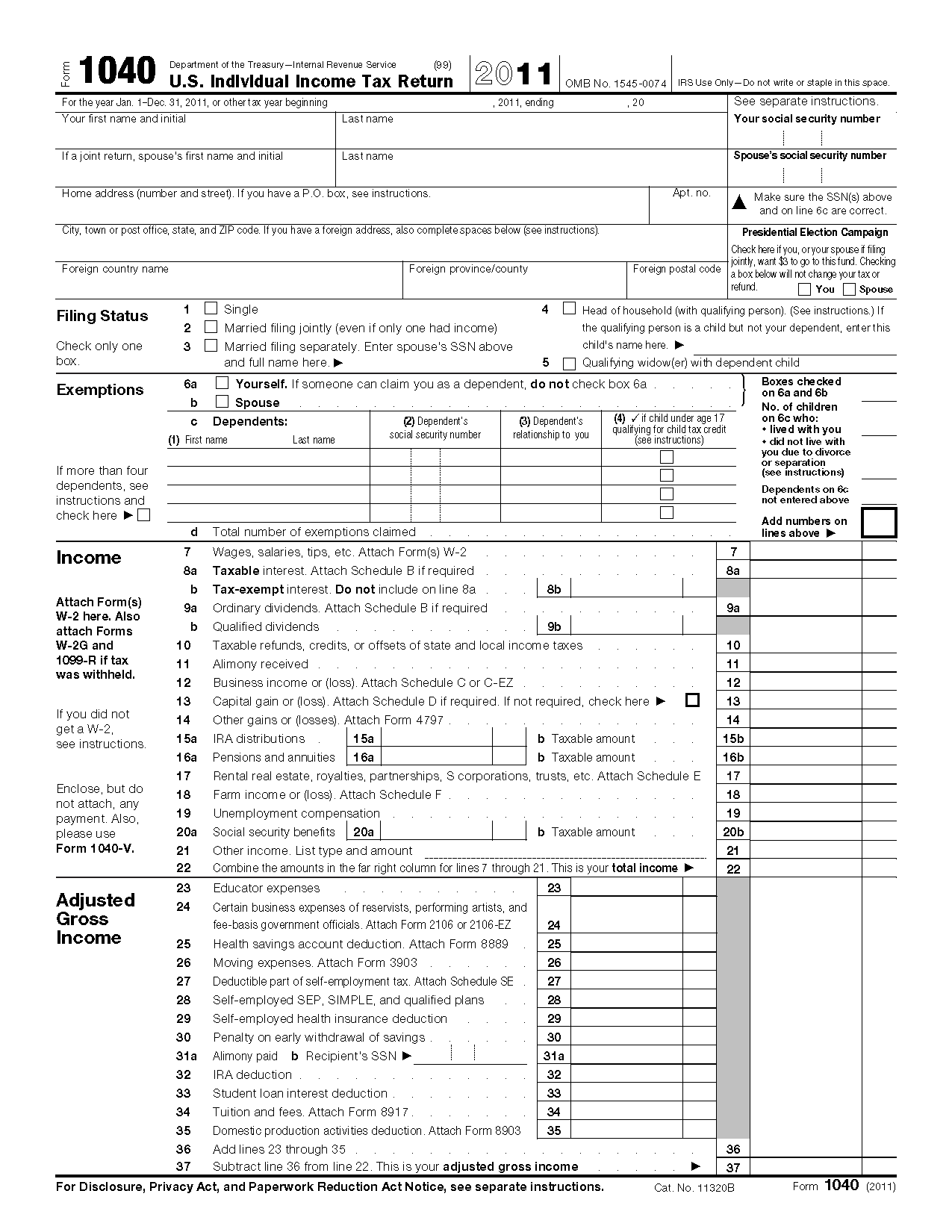

2018 1040a Income Tax Printable Form

2018 1040a Income Tax Printable Form

Get and Print 2018 1040a Income Tax Printable Form

The 2018 1040a form is a shorter and simpler version of the standard 1040 form, making it ideal for those with straightforward tax situations. It allows taxpayers to report their income, claim standard deductions, and calculate their tax liability in a clear and concise manner.

When filling out the 2018 1040a form, taxpayers will need to provide information such as their name, address, Social Security number, and filing status. They will also need to report their income, deductions, and credits to determine their taxable income and final tax liability for the year.

After completing the 2018 1040a form, taxpayers can either file it electronically or mail it to the IRS along with any supporting documents and payment, if applicable. It is important to double-check all information entered on the form to avoid any errors or delays in processing your tax return.

In conclusion, the 2018 1040a Income Tax Printable Form is a valuable tool for individuals with simple tax situations to report their income and calculate their tax liability for the year. By ensuring you have the correct form and all necessary information, you can file your taxes accurately and on time, avoiding any potential penalties or issues with the IRS.