As tax season approaches, Canadians are getting ready to file their income tax returns for the year 2015. It is important to have the necessary forms and documents in order to accurately report your income and claim any deductions or credits that you may be eligible for.

One of the key components of filing your taxes is having access to the correct forms. In Canada, the Canada Revenue Agency (CRA) provides printable forms that can be easily downloaded from their website or picked up at various locations such as post offices or libraries.

2015 Income Tax Forms Printable Canada

2015 Income Tax Forms Printable Canada

Quickly Access and Print 2015 Income Tax Forms Printable Canada

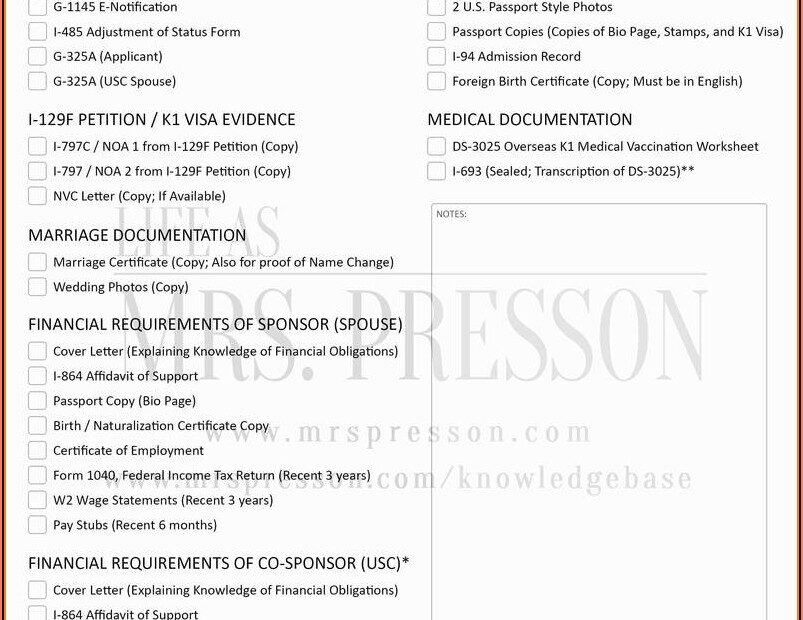

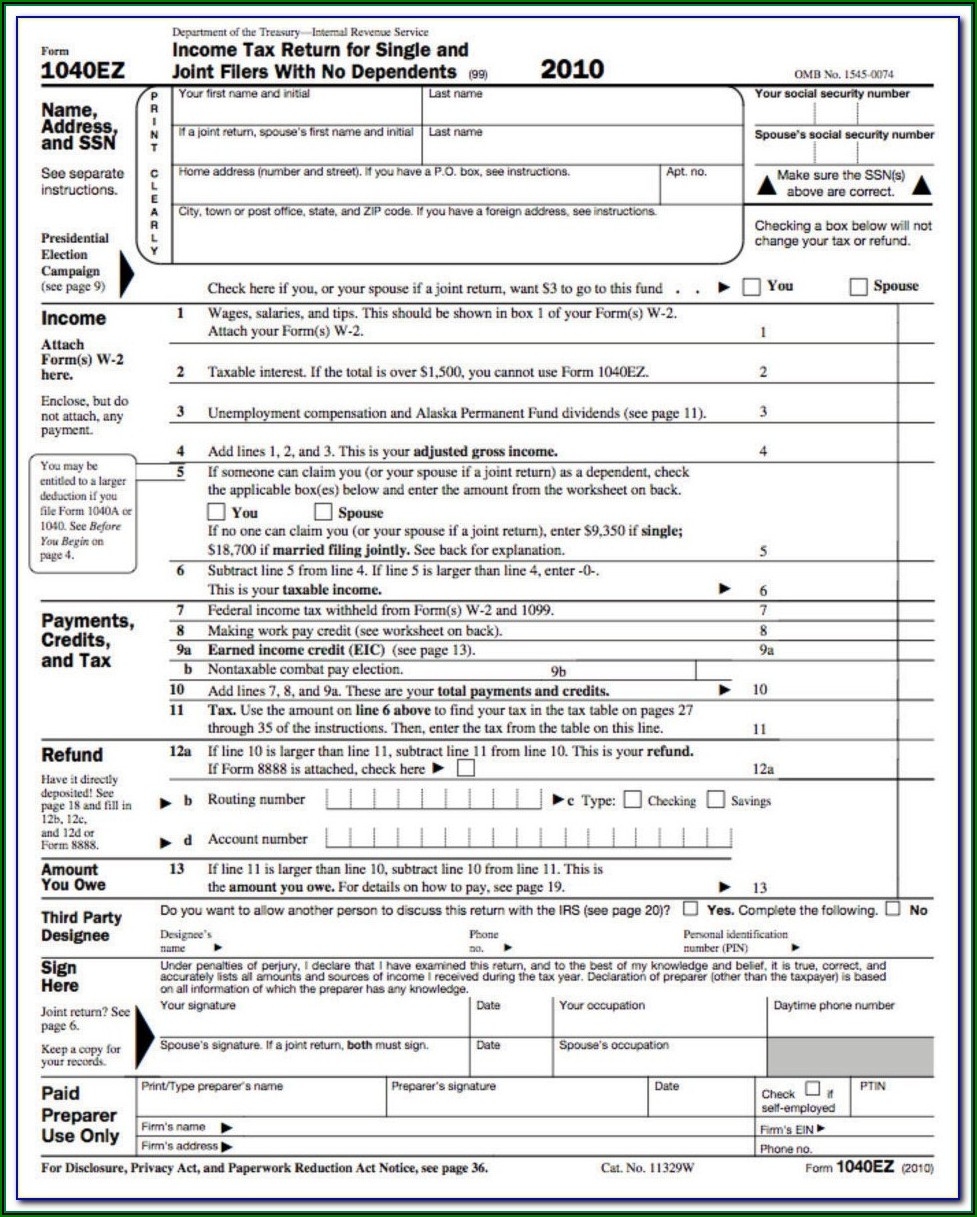

When it comes to filing your 2015 income taxes, there are a variety of forms that you may need to complete depending on your individual financial situation. Some of the most common forms include the T1 General form for individuals, the T2 Corporation Income Tax Return for businesses, and the T4 Statement of Remuneration Paid for employees.

It is important to carefully review each form and ensure that all information is accurately reported. Any errors or omissions could result in delays in processing your return or potential penalties from the CRA. If you are unsure about how to fill out a particular form, it may be helpful to seek assistance from a tax professional or accountant.

Once you have completed all necessary forms, you can submit your tax return to the CRA either electronically or by mail. It is recommended to keep copies of all documents for your records in case you need to refer back to them in the future.

In conclusion, having access to printable income tax forms for the year 2015 is essential for Canadians to accurately report their income and comply with tax regulations. By taking the time to carefully complete and submit all required forms, you can ensure that your tax return is processed efficiently and accurately.