As tax season approaches, many individuals and businesses are gearing up to file their taxes. One important document that plays a crucial role in this process is the 1099 form. These forms are used to report various types of income, such as freelance work, rental income, or investment earnings. Understanding how to properly fill out and submit these forms is essential for ensuring compliance with tax laws.

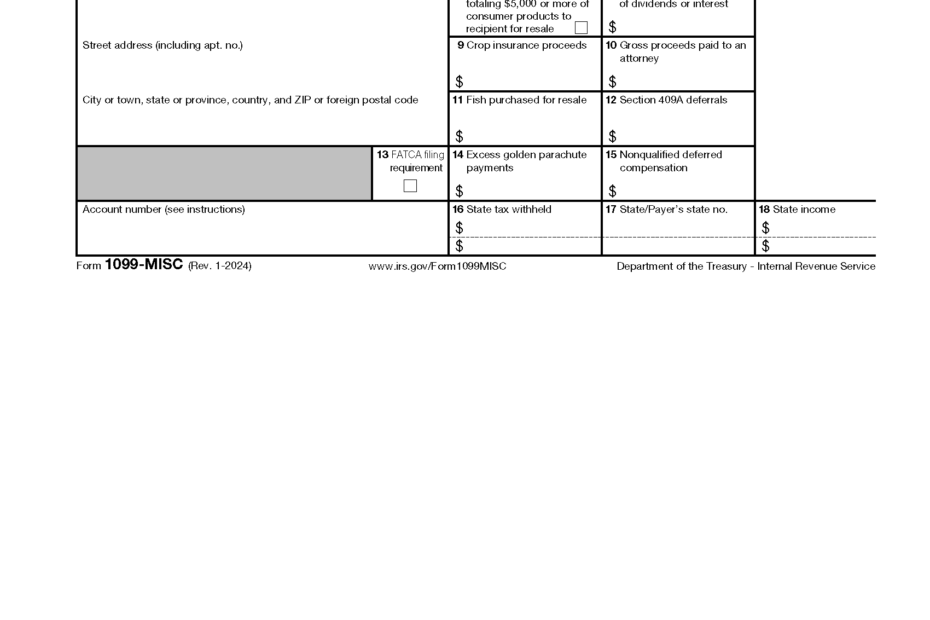

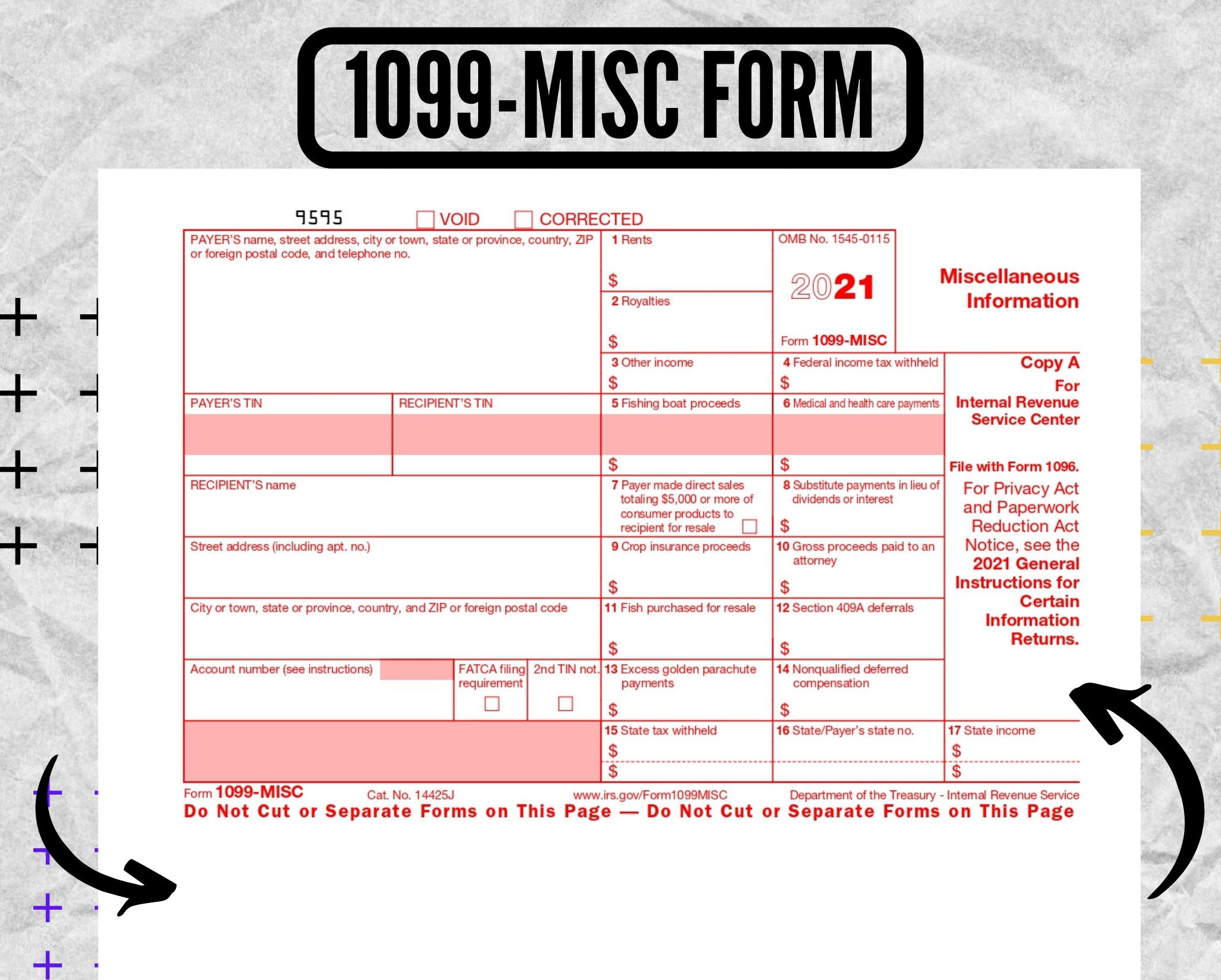

1099 forms are typically provided by payers to recipients who have received income from them during the tax year. These forms come in various versions, such as 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income. It is important to accurately report all income on these forms to avoid penalties or audits from the IRS.

Easily Download and Print 1099 Printable Forms

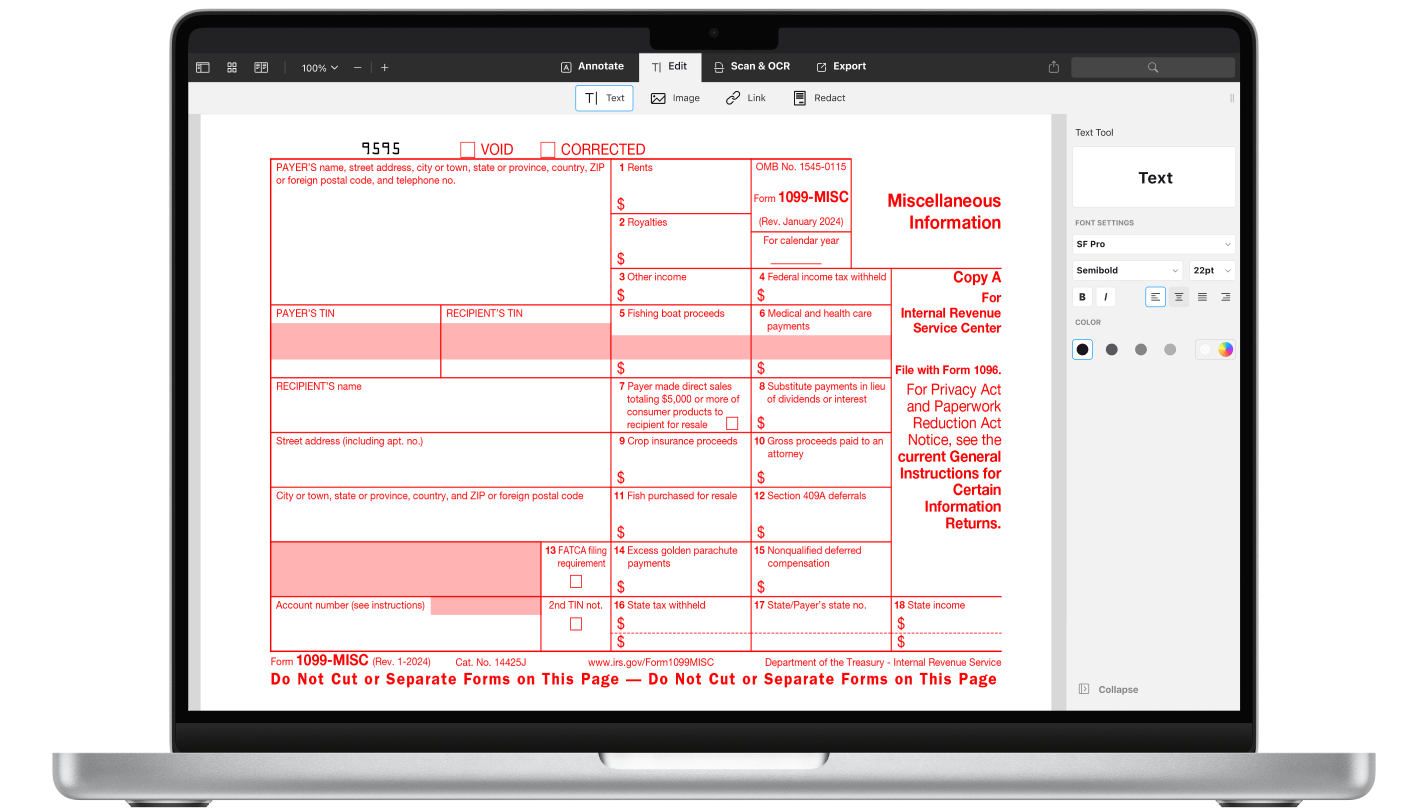

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

1099 Printable Forms

For those who need to file a 1099 form, printable versions are available online. These forms can be easily downloaded and printed from the IRS website or other reputable sources. Once printed, individuals can fill out the necessary information, such as their name, address, and social security number, as well as details about the income they received.

It is important to ensure that the information on the 1099 form is accurate and matches the records of the payer. Any discrepancies could lead to delays in processing the tax return or trigger an audit. Once the form is complete, it should be submitted to the IRS along with the individual’s tax return by the filing deadline.

Overall, understanding and properly filing 1099 forms is essential for individuals and businesses that receive various types of income throughout the year. By utilizing printable versions of these forms, individuals can easily report their income and avoid potential issues with the IRS. It is always recommended to seek professional assistance if there are any questions or concerns about filling out these forms correctly.

In conclusion, 1099 printable forms are a valuable tool for individuals and businesses to report various types of income to the IRS. By understanding how to properly fill out and submit these forms, taxpayers can ensure compliance with tax laws and avoid potential penalties. Utilizing printable versions of these forms makes the process easier and more convenient for all parties involved.