As tax season approaches, it’s important to be prepared with all the necessary forms and documents. One form that many individuals and businesses may need to fill out is the 1099 IRS form. This form is used to report various types of income, such as freelance earnings, rental income, and more. Understanding how to properly fill out and submit the 1099 form is essential to staying in compliance with IRS regulations.

Whether you’re a freelancer, independent contractor, or small business owner, the 1099 IRS form is a crucial document for reporting income that is not subject to withholding. This form is used to report income earned through various sources, such as self-employment, investments, and rental properties. Filing the 1099 form accurately and on time is important to avoid penalties and ensure that your tax obligations are met.

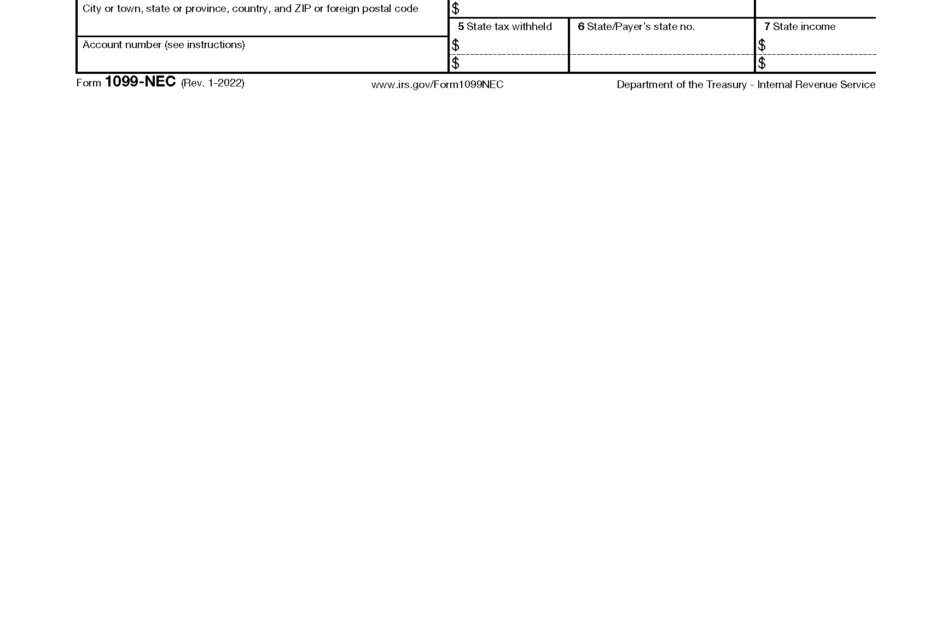

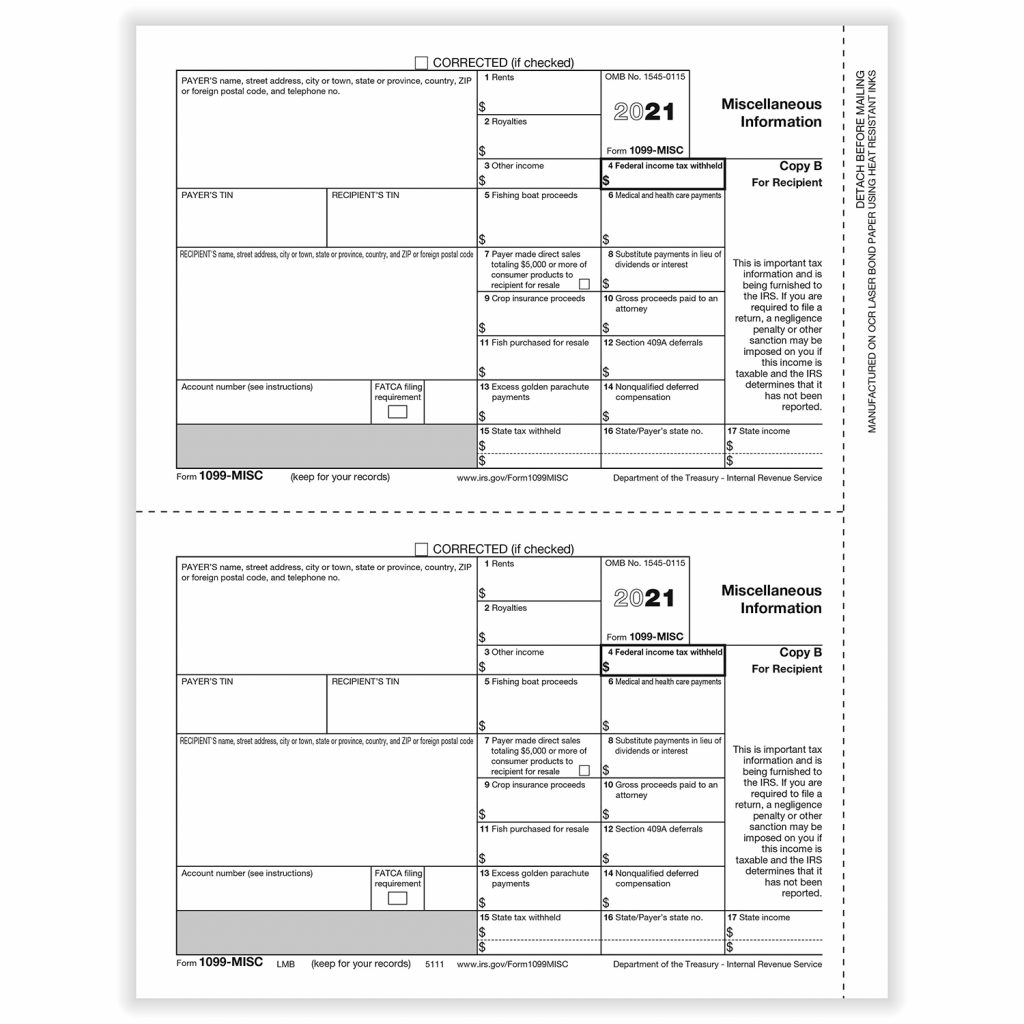

Get and Print 1099 Irs Form Printable

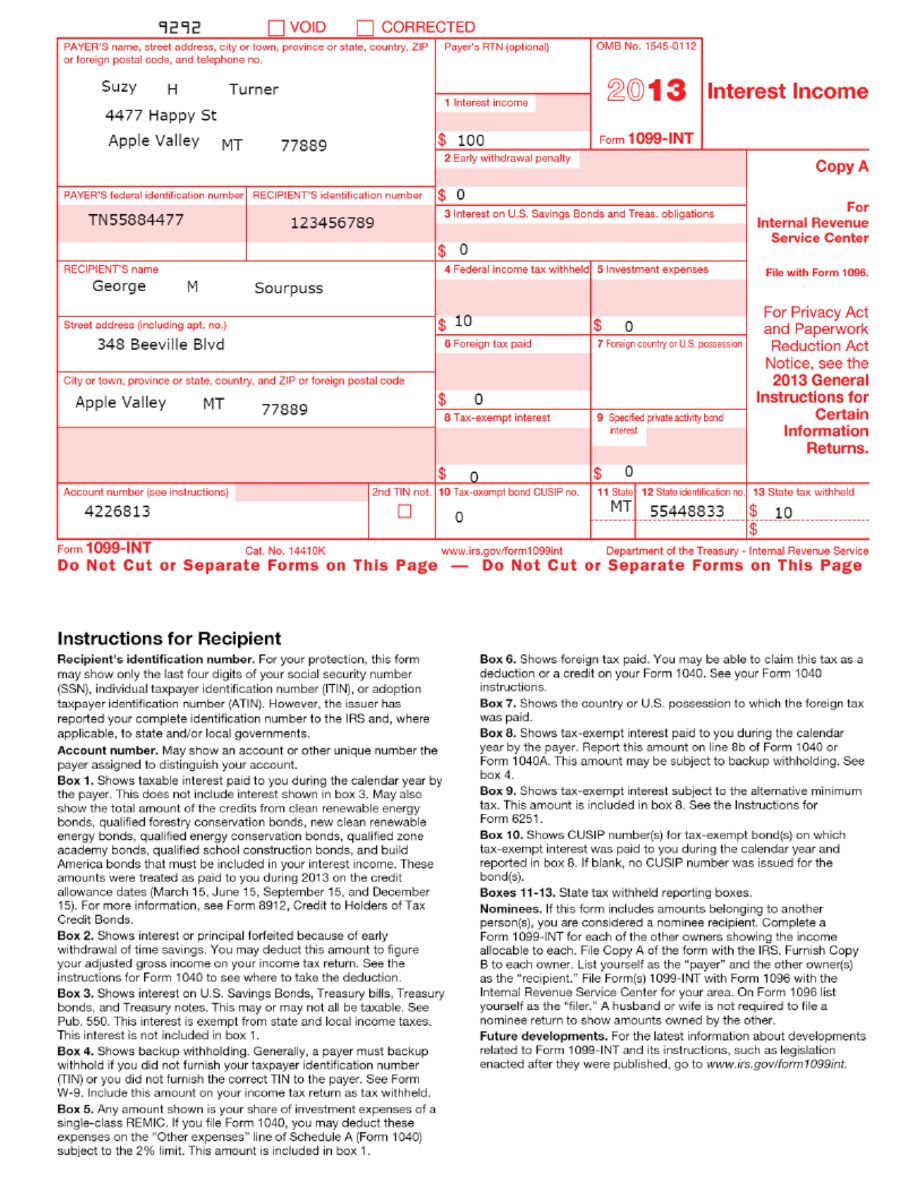

Printable 1099 Int Form 2024 1099 INT Tax Forms 25 Pack IRS Approved For Interest Income Reporting 1099 Int Form 2023

Printable 1099 Int Form 2024 1099 INT Tax Forms 25 Pack IRS Approved For Interest Income Reporting 1099 Int Form 2023

1099 IRS Form Printable

One convenient way to access the 1099 IRS form is through the IRS website, where you can find a printable version of the form. The printable form can be easily downloaded and printed for your records. It’s important to ensure that you have the most up-to-date version of the form to avoid any errors or delays in processing.

When filling out the 1099 form, you will need to provide information such as your name, address, and taxpayer identification number. You will also need to report the income you received from various sources, along with any taxes that may have been withheld. It’s important to double-check all the information you provide on the form to ensure its accuracy.

Once you have completed the 1099 form, you will need to submit it to both the recipient of the income and the IRS. The deadline for submitting the form varies depending on the type of income being reported, so it’s important to check the IRS guidelines for specific deadlines. Failing to submit the form on time can result in penalties and fines.

In conclusion, the 1099 IRS form is an essential document for reporting various types of income to the IRS. By understanding how to properly fill out and submit the form, you can avoid potential penalties and ensure that your tax obligations are met. Be sure to access the printable version of the form from the IRS website and submit it on time to stay in compliance with IRS regulations.