As we approach tax season, it’s important to familiarize yourself with the necessary forms for reporting income. One such form is the 1099 IRS Form 2025, which is used to report various types of income to the Internal Revenue Service. This form is commonly used by businesses and individuals who receive income from sources other than traditional employment, such as freelance work or investments.

Understanding the 1099 IRS Form 2025 is crucial for ensuring that you are accurately reporting your income and avoiding any potential penalties or audits from the IRS. By familiarizing yourself with this form, you can ensure that you are in compliance with tax laws and regulations.

Get and Print 1099 Irs Form 2025 Printable

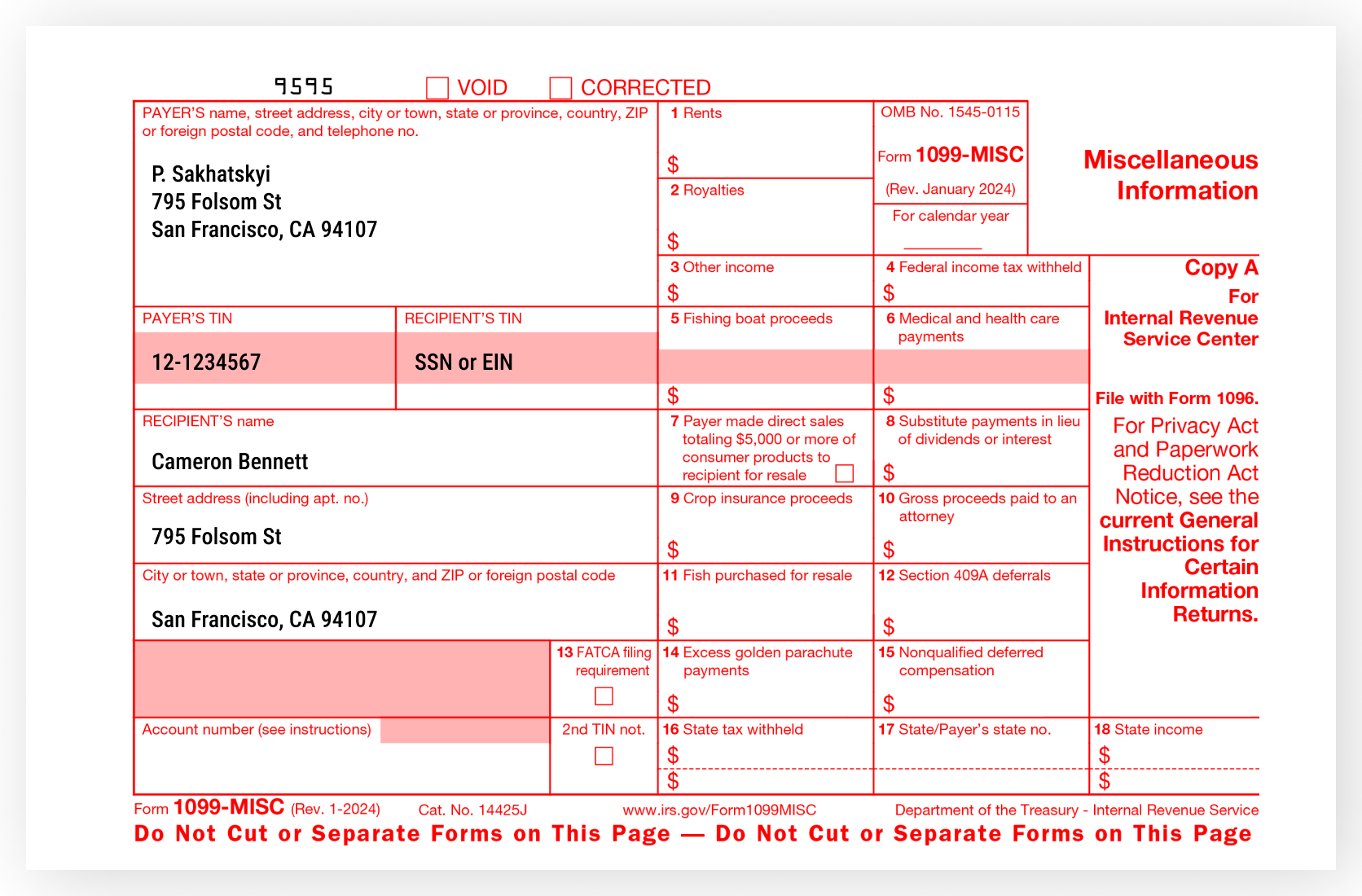

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

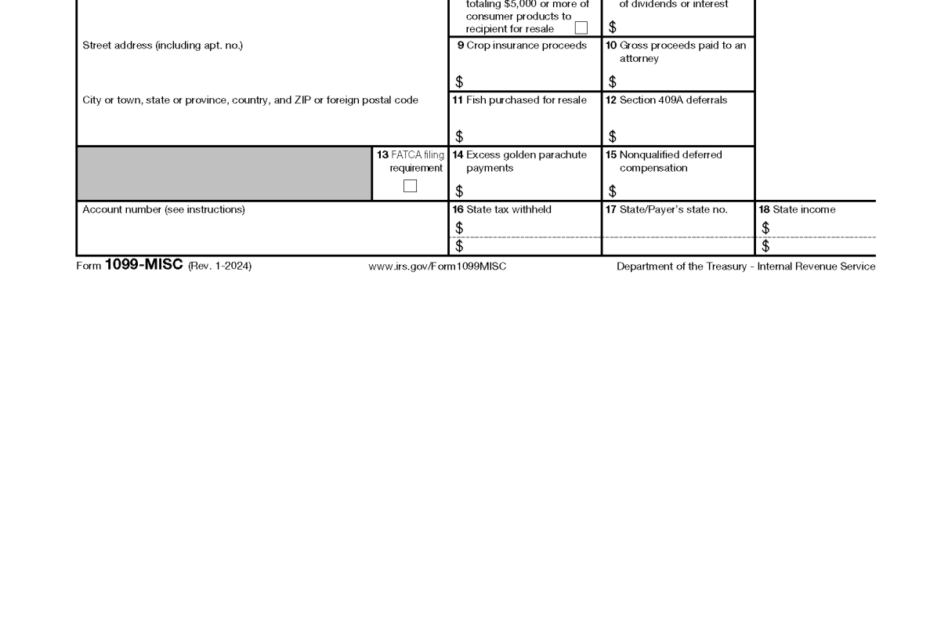

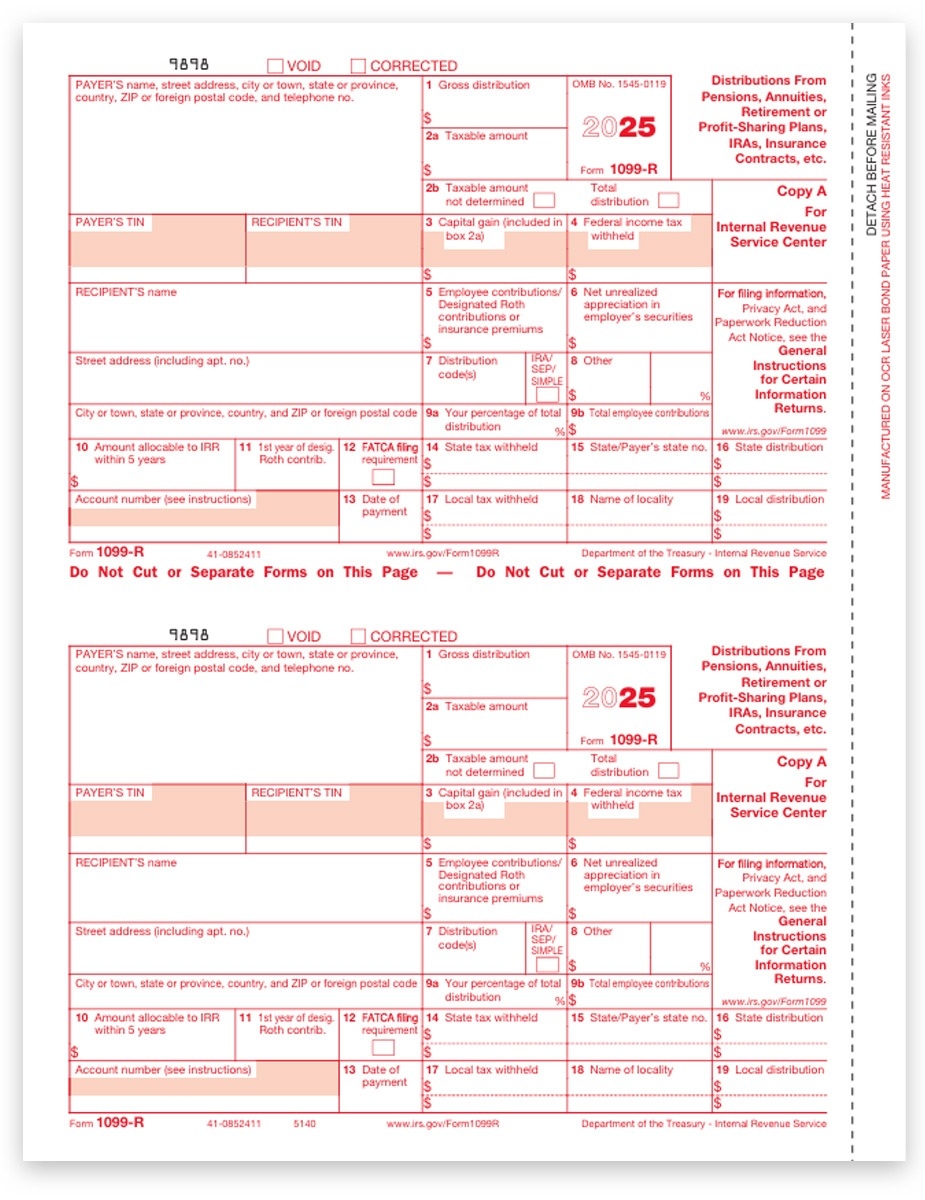

When filling out the 1099 IRS Form 2025, you will need to provide information about the income you received, as well as details about the payer. This form is used to report various types of income, such as freelance earnings, rental income, and investment income. It is important to ensure that all information provided on the form is accurate and up to date.

Once you have completed the 1099 IRS Form 2025, you can either file it electronically or mail it to the IRS. It is important to keep a copy of the form for your records, as well as any supporting documentation that may be required. By filing this form accurately and on time, you can avoid any potential issues with the IRS and ensure that your taxes are filed correctly.

Overall, the 1099 IRS Form 2025 is an important document for reporting income from non-traditional sources. By understanding how to properly fill out and file this form, you can ensure that you are in compliance with tax laws and regulations. Be sure to consult with a tax professional if you have any questions or concerns about this form or any other tax-related matters.

As tax season approaches, it’s essential to stay informed about the necessary forms for reporting income. The 1099 IRS Form 2025 is a crucial document for individuals and businesses who receive income from sources other than traditional employment. By understanding how to properly fill out and file this form, you can ensure that you are in compliance with tax laws and regulations.