Are you a freelancer or an independent contractor who received payments of $600 or more for your services in the previous tax year? If so, you’ll need to report those earnings on a 1099 form when you file your taxes. The 1099 form is used to report various types of income other than wages, salaries, and tips. It is crucial to accurately report this income to avoid penalties from the IRS.

One of the most common types of 1099 forms is the 1099-MISC, which is used to report payments made in the course of a trade or business to individuals who are not employees. The 1099-MISC form includes income from services performed, rents, royalties, and more. It is essential to fill out this form correctly and submit it to the IRS by the deadline to avoid any issues.

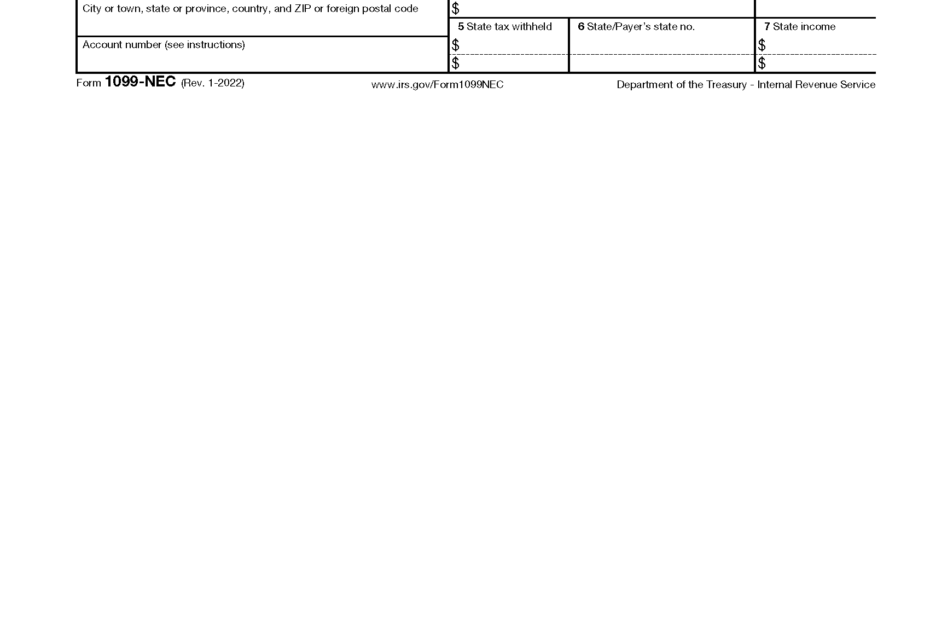

Download and Print 1099 Form 2024 Printable

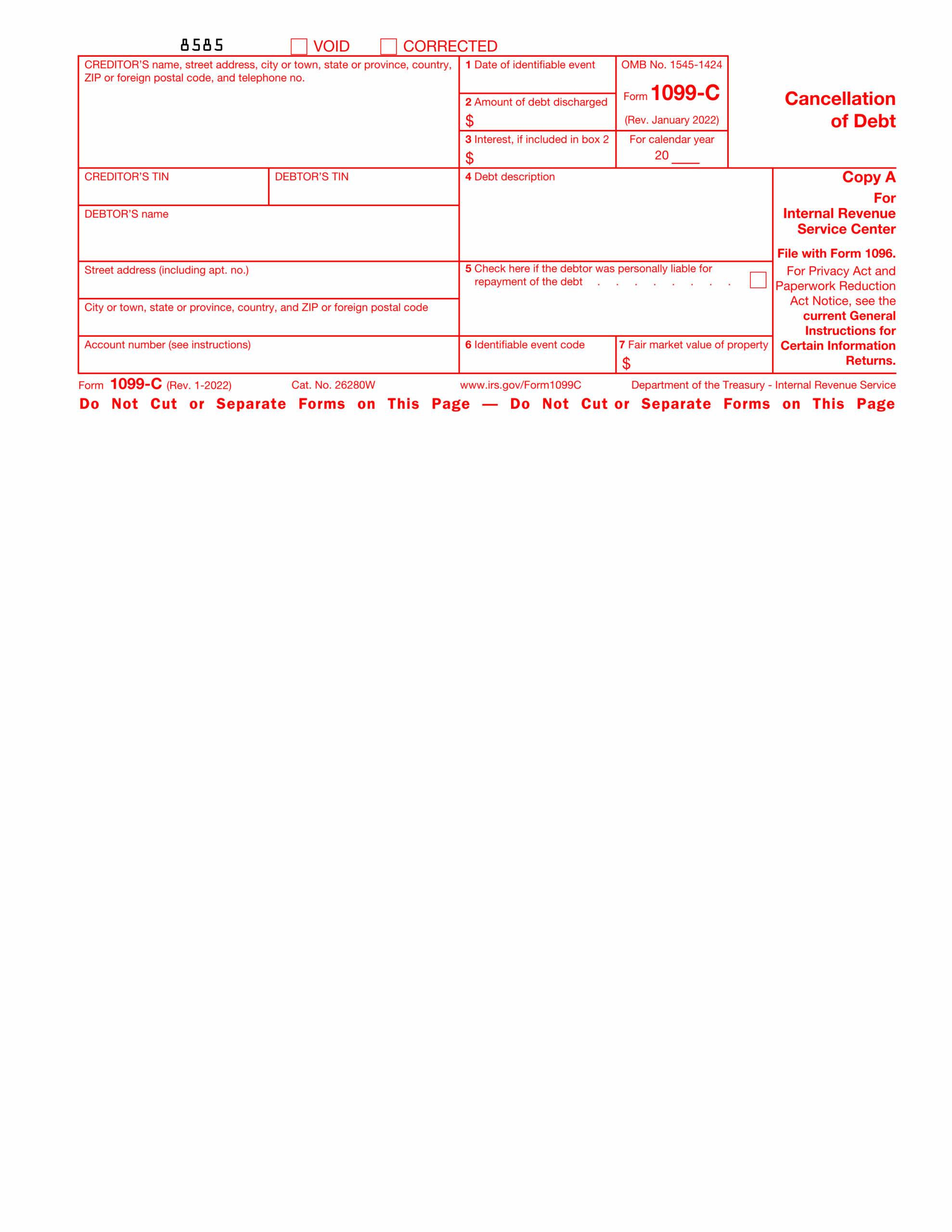

Form 1099 C 2024 2025 Fill Out U0026 Download Online PDF Guru

Form 1099 C 2024 2025 Fill Out U0026 Download Online PDF Guru

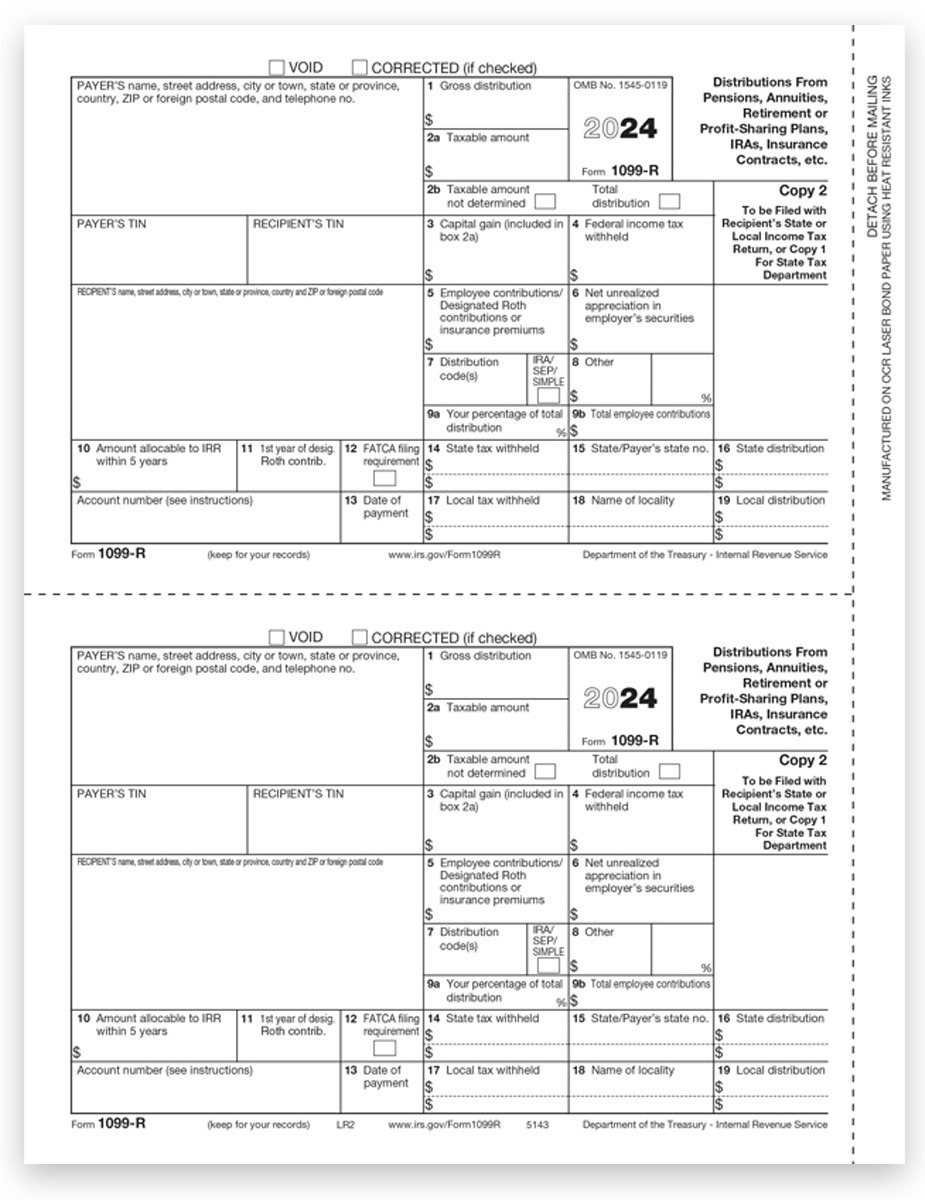

For the year 2024, you can easily access and print the 1099 form online. The 1099 Form 2024 Printable is available on various websites and can be downloaded for free. Make sure to fill out all the necessary information accurately, including your Social Security number or Employer Identification Number, the payer’s information, and the total amount of income received.

When printing the 1099 form, make sure to use the correct paper size and print quality to ensure that the form is clear and legible. It is essential to keep a copy of the completed form for your records and to provide a copy to the IRS and the recipient of the income. Remember to submit the form by the deadline to avoid any penalties or fines.

Overall, the 1099 Form 2024 Printable is a valuable tool for freelancers and independent contractors to report their income accurately and comply with IRS regulations. By filling out the form correctly and submitting it on time, you can avoid potential issues and penalties. Make sure to stay organized and keep track of all your income and expenses throughout the year to make tax time a smooth process.

Get ahead of the game and download your 1099 Form 2024 Printable today to start preparing for tax season. Remember, it’s better to be proactive and take care of your tax obligations early on to avoid any last-minute stress. Stay informed and compliant with the IRS requirements to ensure a smooth tax-filing process.