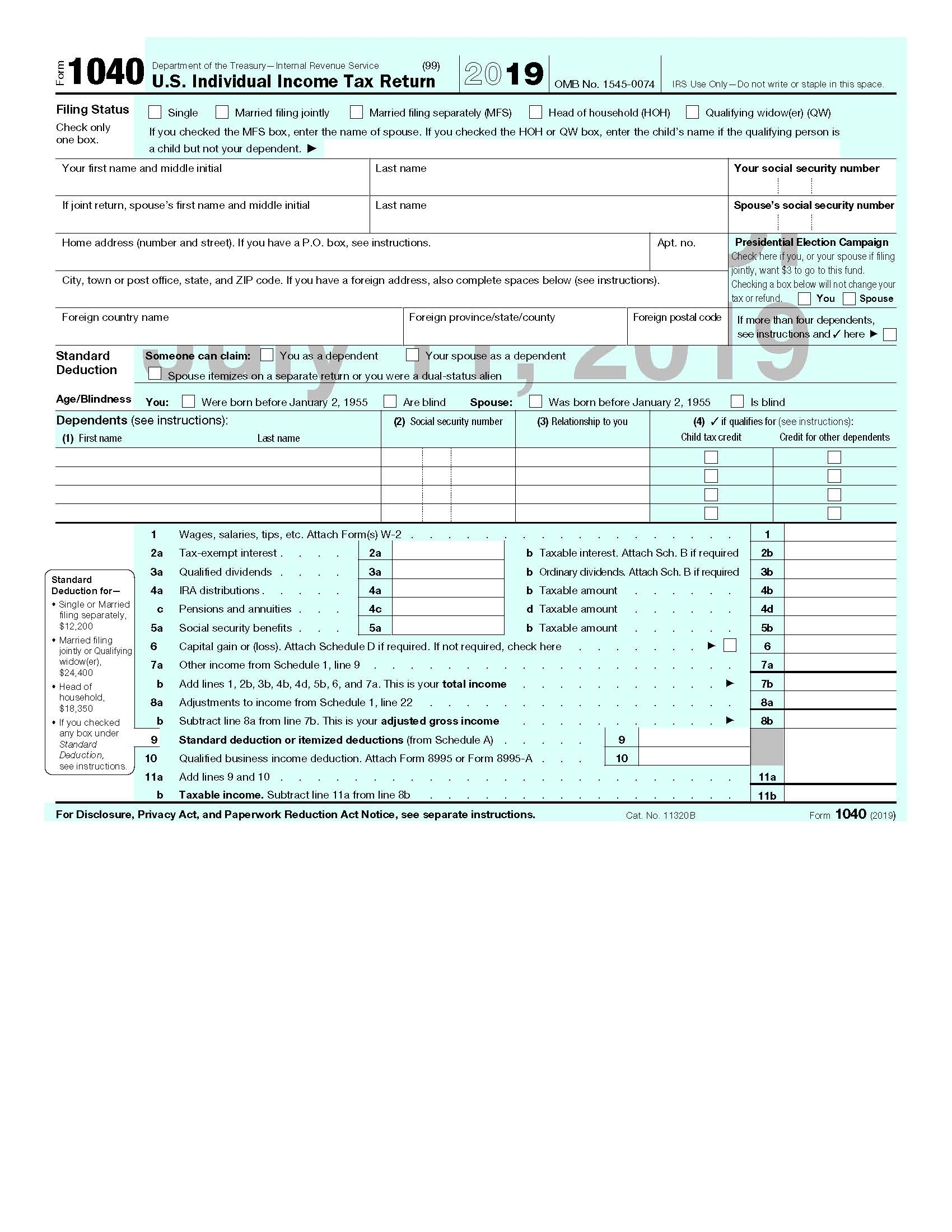

When tax season rolls around, one of the most important documents you will need is the 1040 tax form. This form is used by individuals to report their income, claim deductions and credits, and calculate their tax liability. It is a crucial document that must be filled out accurately to avoid any penalties or issues with the IRS.

For those who prefer to file their taxes on paper rather than electronically, having access to printable 1040 tax forms is essential. These forms can be easily downloaded from the IRS website or obtained from a local tax office. They provide a convenient way to organize and input all the necessary information required for filing your taxes.

Get and Print 1040 Tax Forms Printable

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

When filling out the 1040 tax form, it is important to carefully follow the instructions provided. Make sure to enter all income sources, deductions, and credits accurately to ensure that your tax return is processed correctly. Double-check your calculations and review your form before submitting it to avoid any errors that could delay your refund or result in additional taxes owed.

One of the advantages of using printable 1040 tax forms is that you can work on them at your own pace. You can gather all the necessary documents and information needed to complete the form and take your time filling it out accurately. This can help reduce the stress and pressure of rushing to meet the tax filing deadline.

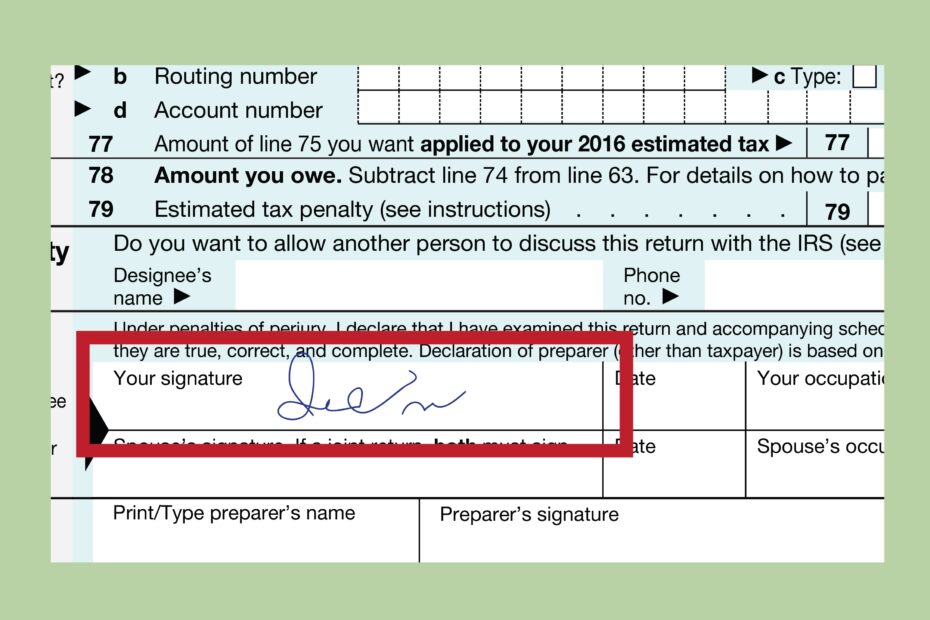

After you have completed your 1040 tax form, make sure to sign and date it before mailing it to the IRS. Keep a copy of the form and any supporting documents for your records. If you are expecting a refund, you can track the status of your return online using the IRS website or by calling their helpline.

In conclusion, having access to printable 1040 tax forms is essential for individuals who prefer to file their taxes on paper. By carefully following the instructions and accurately entering all the required information, you can ensure that your tax return is processed correctly and timely. Make sure to review your form before submitting it and keep copies of all documents for your records.