As tax season approaches, many individuals are gearing up to file their annual tax returns. One essential document that taxpayers will need to familiarize themselves with is the 1040 Printable Tax Form. This form is used by individuals to report their income, calculate their tax liability, and determine whether they owe taxes or are eligible for a refund.

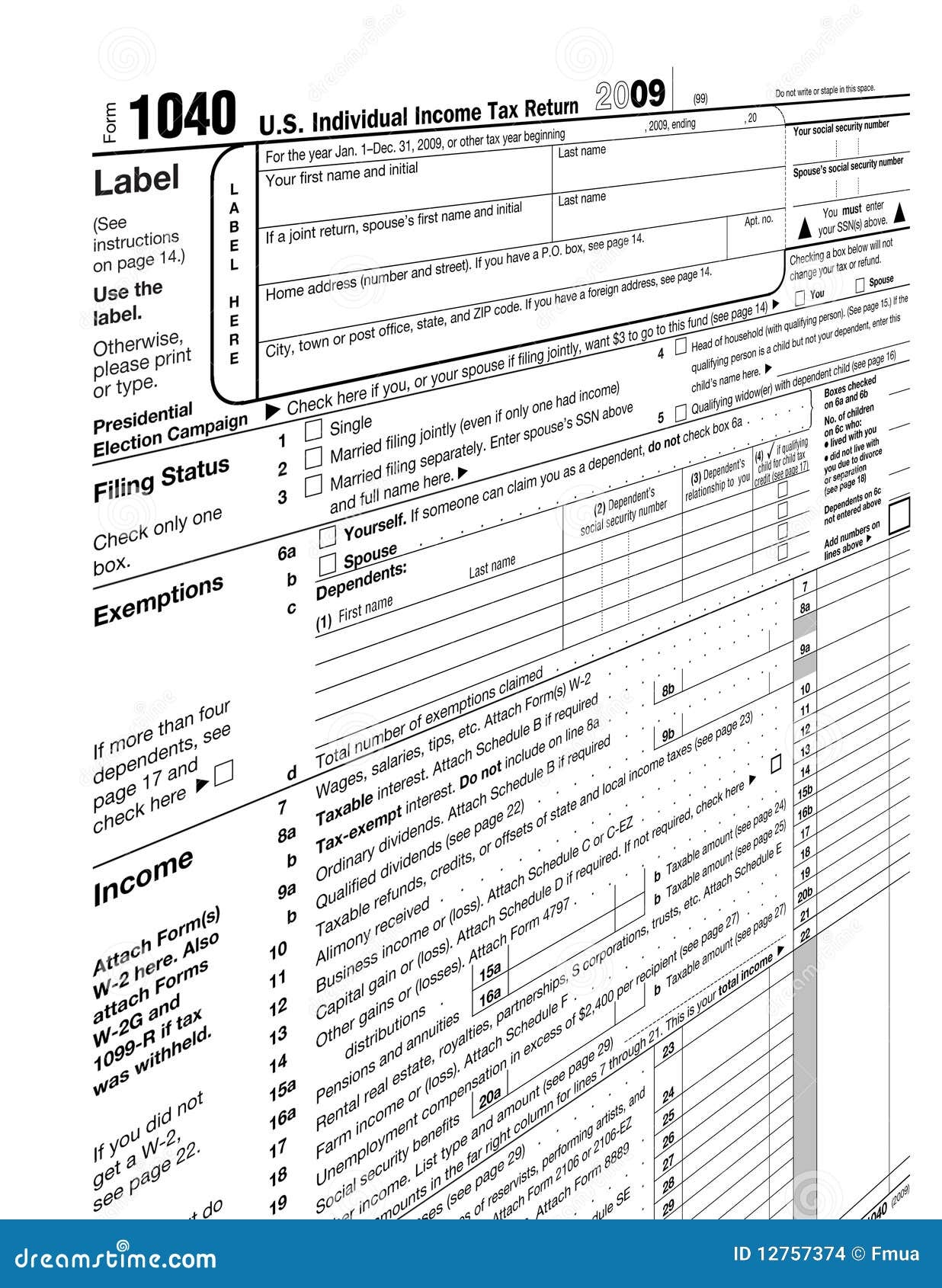

The 1040 Printable Tax Form is the standard form that most taxpayers use to file their federal income tax return. It is divided into several sections, including personal information, income, deductions, and credits. Taxpayers must carefully fill out each section of the form to ensure accuracy and compliance with tax laws.

Download and Print 1040 Printable Tax Form

Empty Form 1040 Blank Taxes Stock Photo Image Of Address Federal 12730422

Empty Form 1040 Blank Taxes Stock Photo Image Of Address Federal 12730422

One of the key sections of the 1040 form is the income section, where taxpayers must report all sources of income, including wages, salaries, tips, and investment income. Additionally, taxpayers must report any deductions they are eligible for, such as mortgage interest, medical expenses, and charitable contributions. These deductions can help reduce a taxpayer’s taxable income and ultimately lower their tax liability.

Another important aspect of the 1040 form is the credits section, where taxpayers can claim various tax credits, such as the Earned Income Tax Credit or the Child Tax Credit. These credits can significantly reduce a taxpayer’s tax bill or even result in a refund if the credits exceed the amount of tax owed.

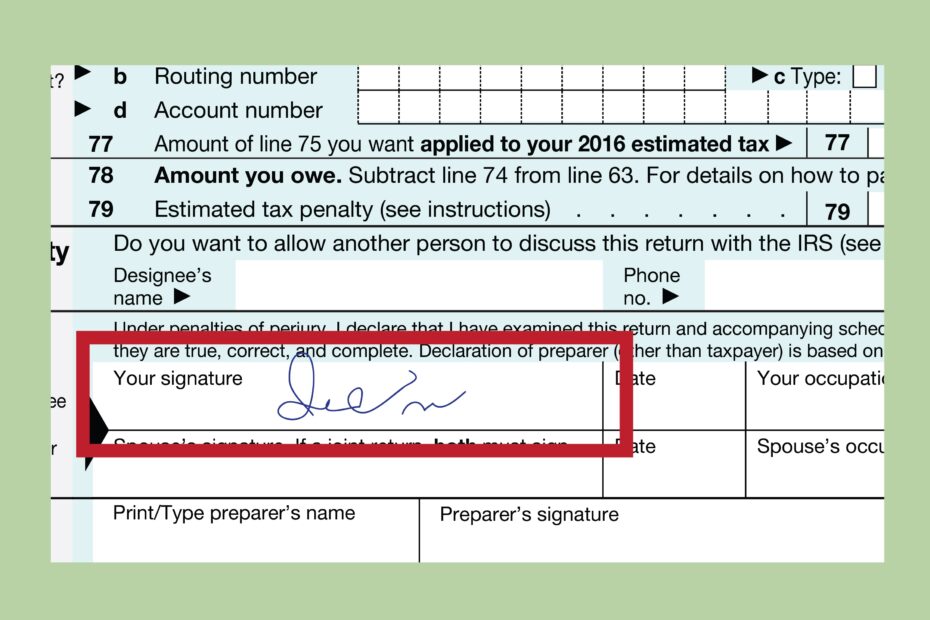

Once taxpayers have completed all sections of the 1040 form, they must carefully review their return for accuracy before submitting it to the Internal Revenue Service (IRS). Taxpayers can then choose to file their return electronically or mail a paper copy of the form to the IRS.

In conclusion, the 1040 Printable Tax Form is a crucial document that taxpayers must understand and complete accurately to fulfill their tax obligations. By carefully filling out each section of the form and taking advantage of available deductions and credits, taxpayers can maximize their tax savings and ensure compliance with the tax laws.