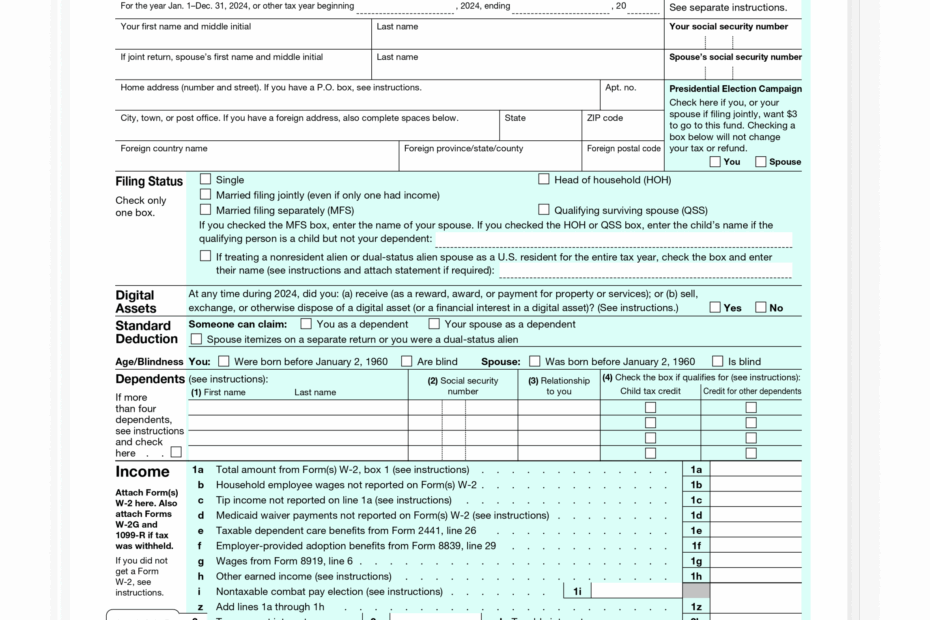

When tax season rolls around, it’s important to make sure you have all the necessary forms to properly file your taxes. One of the most commonly used forms is the 1040 Printable Form, which is used by individuals to report their annual income to the IRS. Filling out this form accurately and completely is crucial to avoid any penalties or fines.

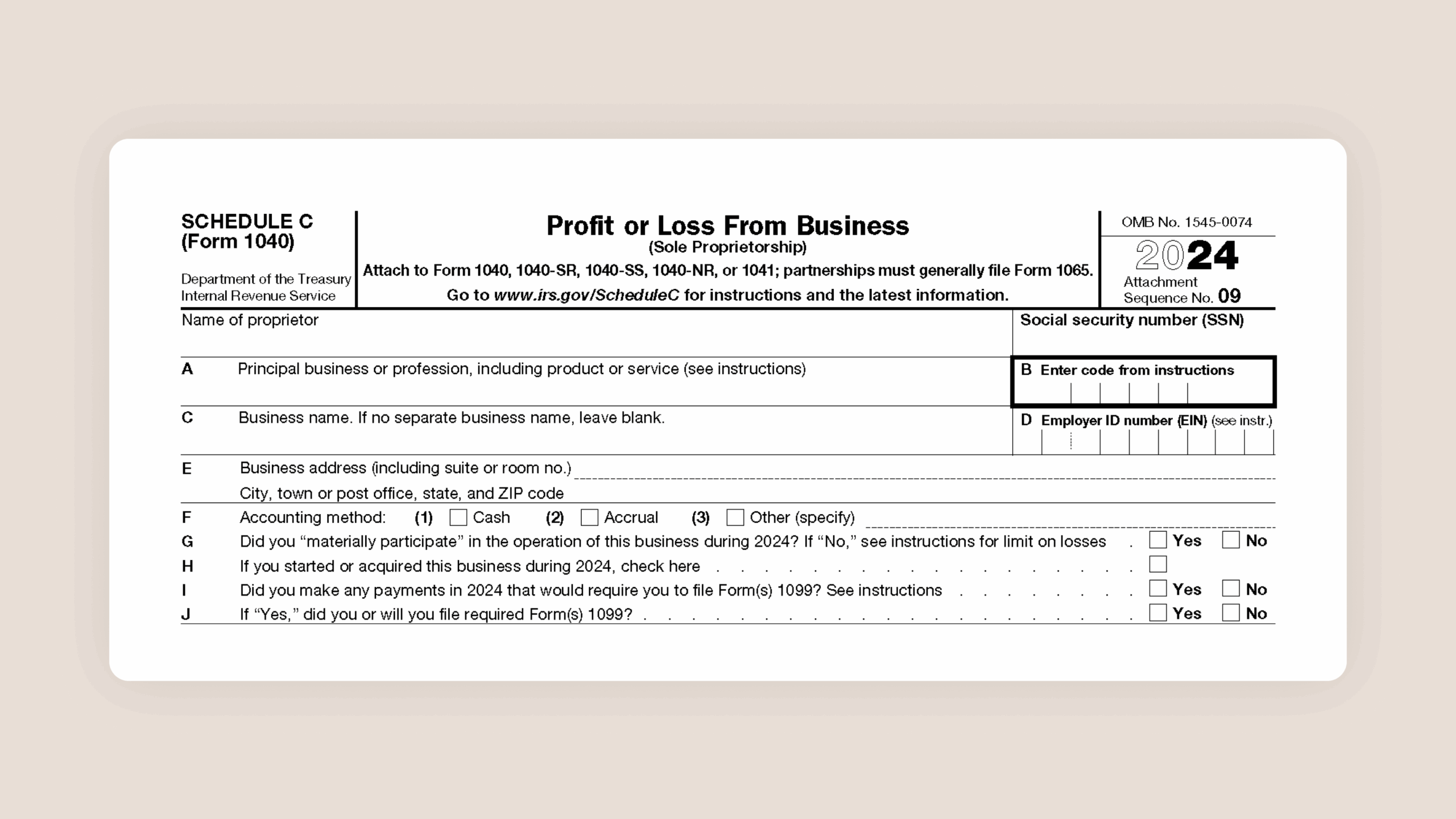

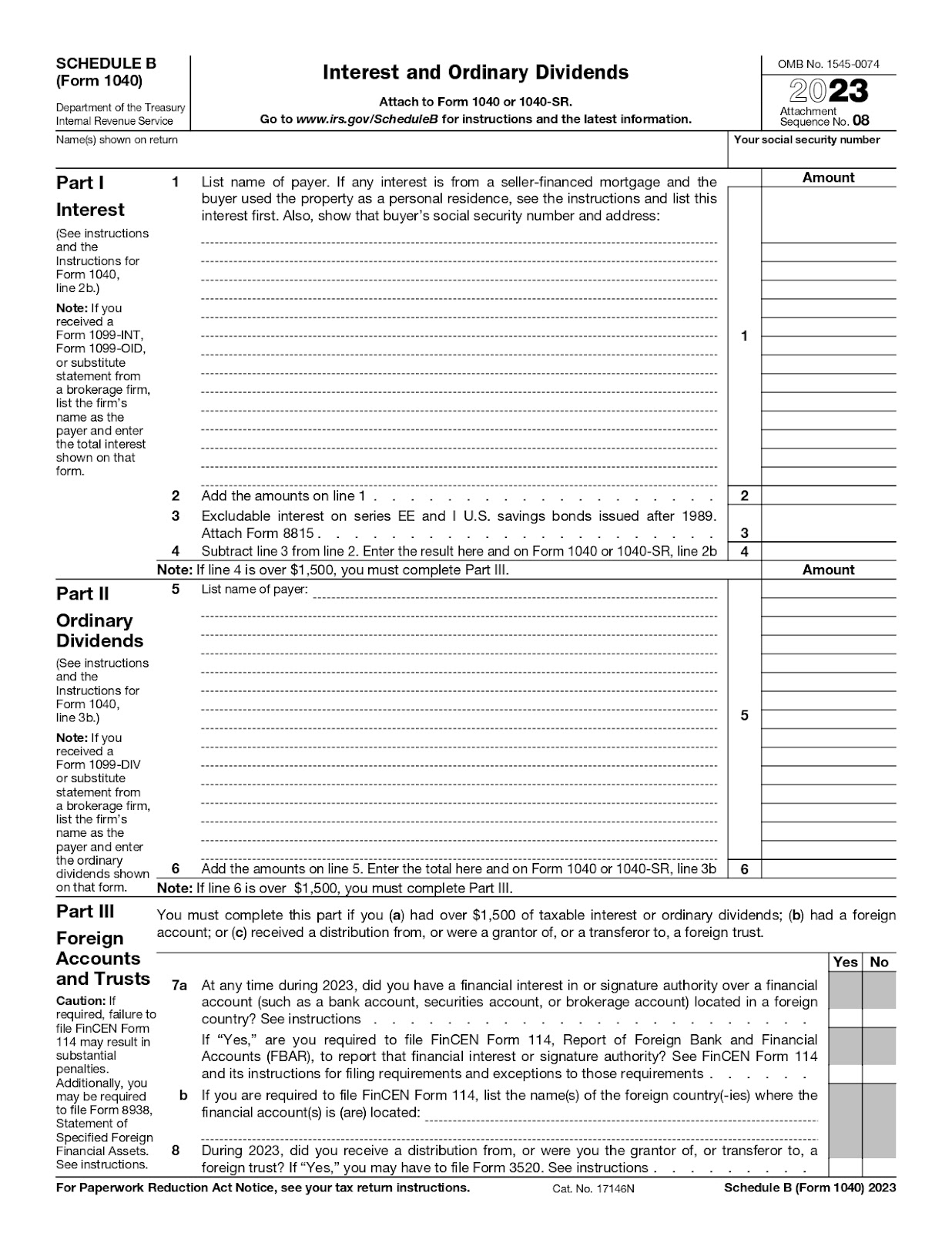

Whether you’re a salaried employee, self-employed individual, or have income from other sources, the 1040 form is a key document in determining how much you owe in taxes or if you are entitled to a refund. It’s essential to gather all your financial records and receipts before filling out the form to ensure accuracy.

Easily Download and Print 1040 Printable Form

Essential Tax Forms For U S Individuals

Essential Tax Forms For U S Individuals

1040 Printable Form

The 1040 form is divided into several sections, including income, deductions, credits, and taxes owed. It’s important to carefully review each section and enter the correct information to avoid any errors. The form can be filled out manually or electronically, depending on your preference.

When completing the 1040 form, be sure to double-check all calculations and verify that all required fields are filled out. Any mistakes or missing information can delay the processing of your tax return and may result in additional scrutiny from the IRS. It’s always a good idea to review your completed form before submitting it to ensure accuracy.

Once you have completed the 1040 form, you can either mail it to the IRS or file electronically using tax preparation software. Filing electronically is often faster and can result in quicker refunds. However, if you prefer to mail your form, be sure to send it to the correct address and include any necessary documentation.

In conclusion, filling out the 1040 Printable Form is an essential part of the tax filing process. By accurately reporting your income and deductions, you can ensure that you are complying with tax laws and avoid any potential penalties. Be sure to take the time to carefully review and complete the form to ensure a smooth tax filing experience.