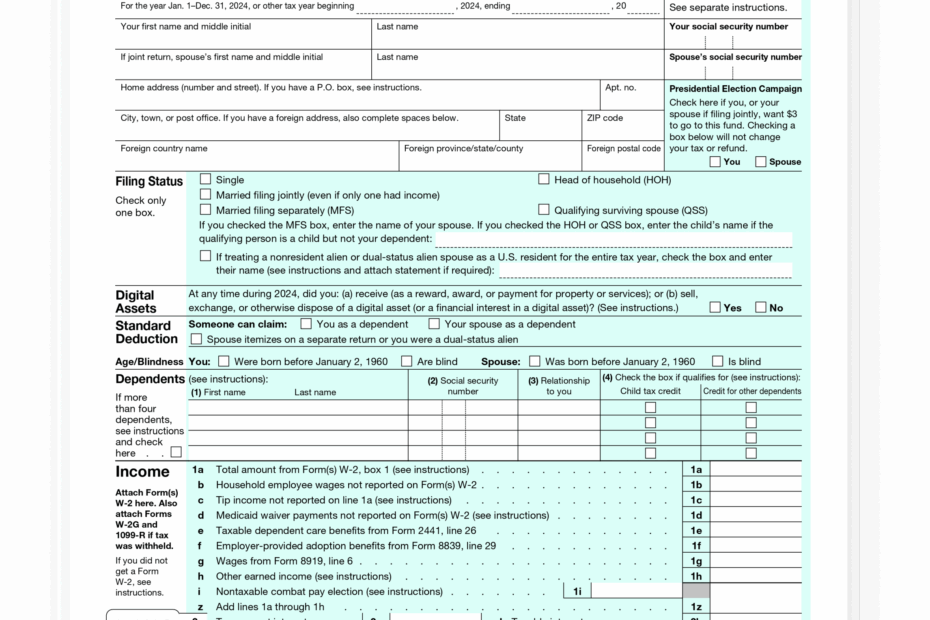

Filing taxes can be a daunting task, but having the right forms can make the process much easier. One of the most commonly used tax forms is the 1040 IRS form, which is used by individuals to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating how much tax you owe or if you are eligible for a refund.

While many people choose to file their taxes online, some prefer to fill out the forms manually. Having a printable version of the 1040 IRS form can be useful for those who prefer this method or for those who want to keep a physical copy for their records.

Download and Print 1040 Irs Form Printable

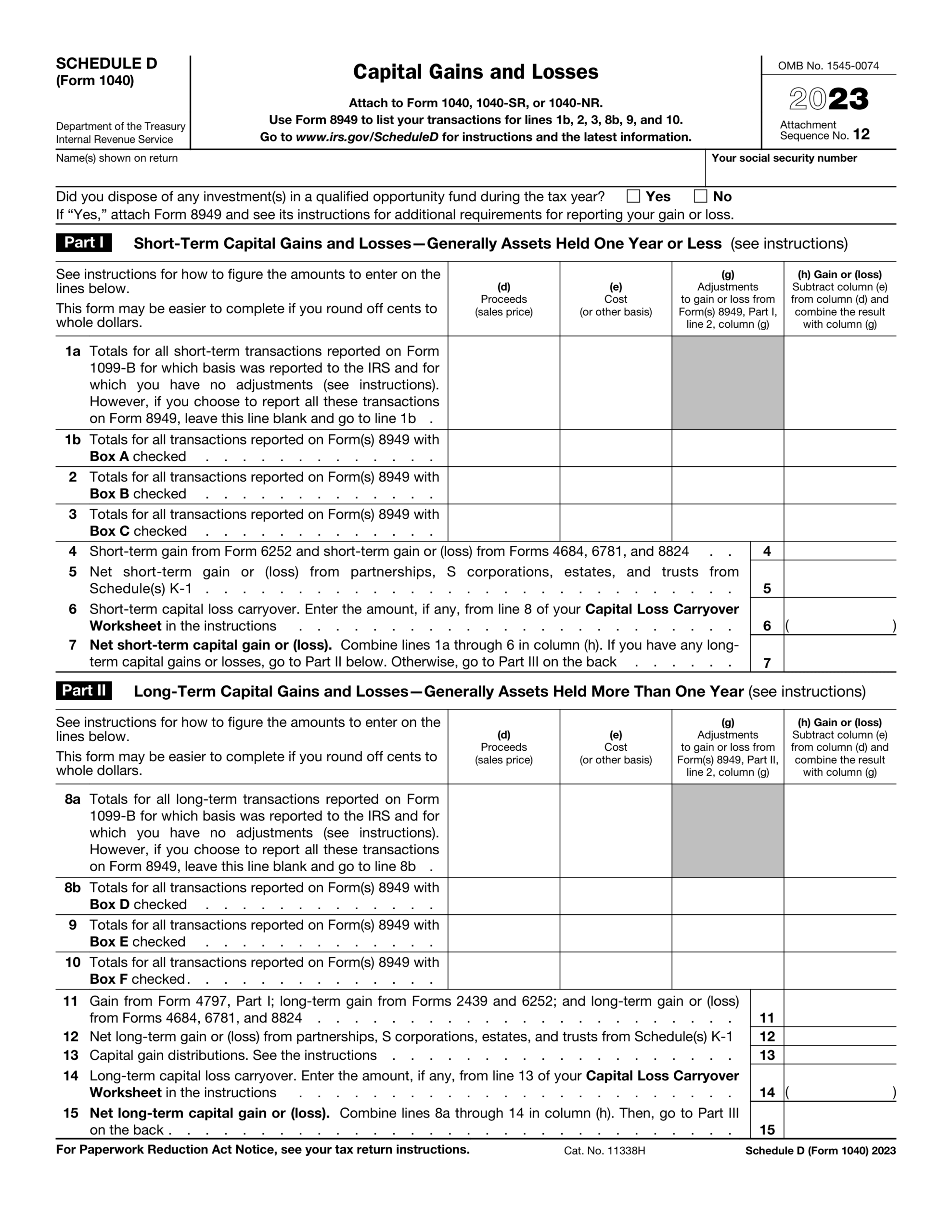

Schedule D Form 1040 2024 2025 Fill And Edit Online PDF Guru

Schedule D Form 1040 2024 2025 Fill And Edit Online PDF Guru

When looking for a printable version of the 1040 IRS form, it is important to ensure that you are using the most up-to-date version. The IRS updates tax forms regularly, so using an outdated form could result in errors or delays in processing your tax return. You can download the official 1040 IRS form from the IRS website or other trusted sources.

Once you have the form printed out, make sure to carefully read the instructions before filling it out. The 1040 form can be complex, especially if you have multiple sources of income or deductions. Double-checking your work and including all necessary documentation can help prevent errors and potential audits.

After completing the form, you can either mail it to the IRS or submit it electronically. Many taxpayers opt for e-filing as it is faster and more convenient. If you are expecting a refund, filing electronically can also speed up the process and help you receive your money sooner.

In conclusion, having access to a printable version of the 1040 IRS form can be beneficial for those who prefer to file their taxes manually or keep physical records. Make sure to use the most recent version of the form and carefully follow the instructions to avoid any mistakes. Whether you choose to file online or by mail, accurately reporting your income is crucial for staying compliant with tax laws and avoiding penalties.