When it comes to filing taxes, the IRS 1040 form is one of the most common forms used by individuals to report their annual income and calculate their tax liability. This form is essential for anyone who earns income in the United States and must be filed by the tax deadline each year.

For those who prefer to file their taxes manually, printable 1040 forms are available online. These forms can be easily downloaded and printed from the IRS website or other reputable sources. Having a printable form on hand can make the tax filing process more convenient and efficient.

Save and Print 1040 Forms Printable

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

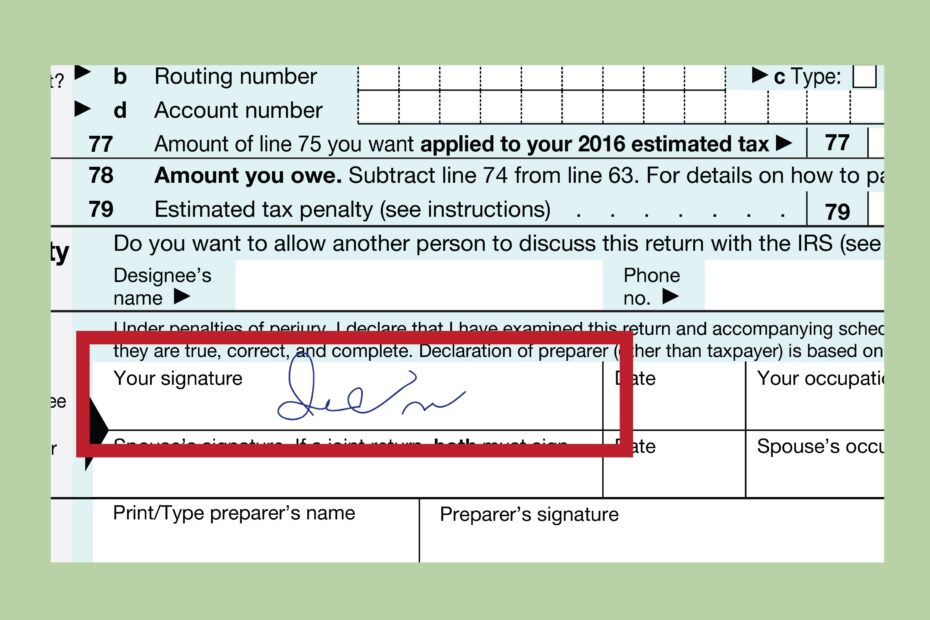

When filling out the 1040 form, it is important to gather all necessary documents, such as W-2s, 1099s, and any other income statements. The form will require information about your income, deductions, credits, and any taxes already paid. Double-checking all calculations and entering accurate information is crucial to avoid errors or delays in processing.

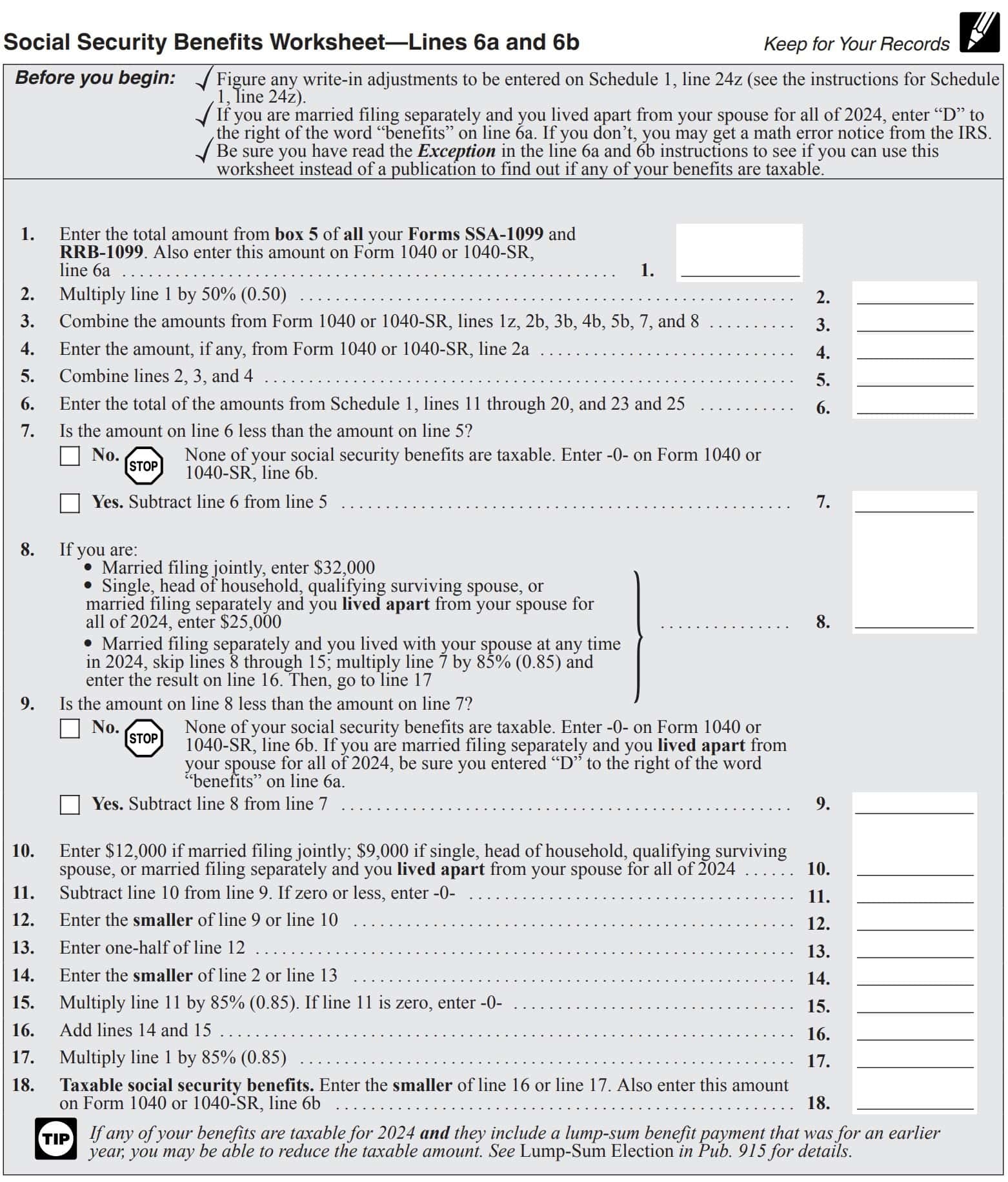

It is also important to understand the various schedules and attachments that may be required with the 1040 form, depending on your individual tax situation. These additional forms can provide more detailed information about specific types of income or deductions, so be sure to review the instructions carefully to ensure you are completing the form correctly.

Once the 1040 form is completed, it can be mailed to the IRS or submitted electronically through an authorized e-file provider. Filing electronically can often result in faster processing and quicker refunds, so it is recommended for those who are able to do so. Regardless of how you choose to file, keeping a copy of your completed form for your records is always a good practice.

In conclusion, printable 1040 forms are a convenient option for individuals who prefer to file their taxes manually. By following the instructions carefully and gathering all necessary documents, you can ensure a smooth and accurate tax filing process. Whether you choose to file by mail or electronically, meeting the tax deadline each year is essential to avoid penalties or fines.